It’s a funny dog image like millions can be found on the internet. In mid-February, Elon Musk posted a photo of his dog Floki dressed as the CEO of Twitter. Knowing its taste for two-way messages, crypto enthusiasts then rushed to the Floki token, driving its price up by 40% in 24 hours. Like the President of El Salvador Nayib Bukele, the American boss of SpaceX and Tesla is, indeed, a personality very followed by the crypto community. However, the popularity of these stars is not representative of the countries that use cryptocurrencies the most on a daily basis.

On the occasion of the Paris Blockchain Week (from March 21 to 23), of which L’Express is a partner, we looked at the new strongholds of this sector. A highly revealing geography of the strengths and weaknesses of this new finance which claims to make trusted third parties superfluous.

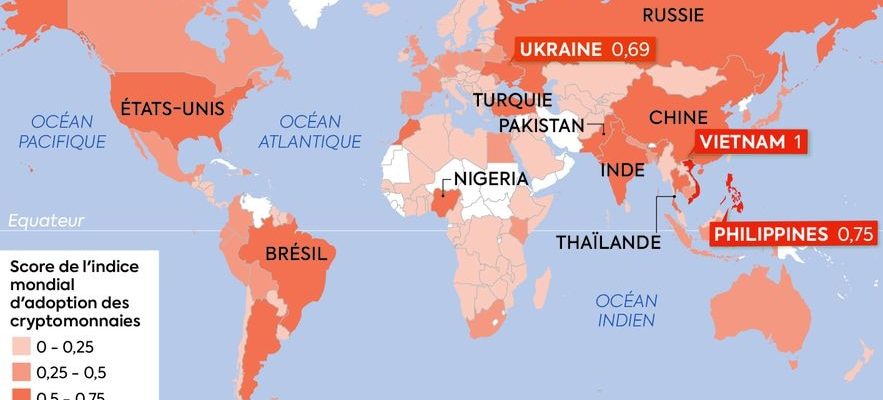

Emerging countries thus largely dominate the 2022 ranking of the adoption rate of cryptos produced by the reference firm Chainalysis. In the top three is Vietnam, followed by the Philippines and Ukraine. Next come India, the United States, Pakistan, Brazil, Thailand and Russia. The reason for this? “Cryptocurrencies offer unique advantages and tangible benefits to people living in unstable economic conditions,” observe the report’s authors. This is particularly the case of countries plagued by galloping inflation such as Argentina (No. 13 in the ranking), or Venezuela (not ranked, but close to 11th place, according to estimates), whose price index increased in 2022 by 234%, after a year 2021 at… + 686%.

© / Art Press

“Bitcoin has yet to demonstrate its ability to be a safe haven, but stablecoins, those cryptos designed to stay pegged to the price of fiat currencies, like the dollar, are popular in inflation-ridden countries,” Chainalysis tip. Other population fond of crypto? The one who regularly transfers funds to a family located in another country. In some areas (in Africa, for example, where many payment systems coexist without always communicating well), these exchanges can be a time-consuming and costly headache. A country like El Salvador, which receives a lot of money from its diaspora, has also crossed the Rubicon by making bitcoin legal tender in 2021. And, on the border between Mexico and the United States, crypto players are nibbling the lucrative market for money transfers abroad (4% provided by the Bitso platform alone in June 2022).

Finally, in Vietnam (No. 1 in the ranking) or the Philippines (No. 2), games allowing you to win small bonuses in crypto, such as the famous Axie Infinity, have caught the eye of low-income populations: a quarter of the inhabitants have already played services of this type.

Cryptocurrencies to the rescue of the oppressed?

In the current worrying geopolitical context, another question burns the lips: can cryptocurrencies help oppressed or attacked populations? The war in Ukraine offered the first elements of an answer. Tails: Blockchains made it possible to quickly and efficiently deliver $65 million in aid to Ukraine. Side face: they also help some Russians to escape sanctions. In Afghanistan, the results are even more mixed. Crypto enthusiasts hoped that these digital assets could covertly support the population against the Taliban. This hope was dashed by the reality on the ground: few inhabitants have a smartphone, and the quality of the Internet network on site is poor.

What about the United States? The country, home to plenty of crypto pros and investors looking for high-risk, high-reward bets, sits well in the top 5 of the rankings. But, as in Europe, cryptos are rarely used there for everyday transactions. A revealing point of the current limits of blockchains. Even if they consume less (Ethereum has reduced its energy consumption by 99%) and manage large volumes of transactions better and better, they do not currently have any real added value for Mr. and Mrs. All- le-Monde in countries like France, with well-banked areas, a stable political regime and a robust currency.