(Tiper Stock Exchange) – The session closed fractionally lower for Piazza Affari, while Euroland grows moderately. In Milan, the positive performance of Pirellibacked by promotion to Overweight by Morgan Stanleyand the negative one of Intesa Sanpaolowith profit taking after the publication of the results of 2022. The CEO Charles Messina he underlined that the outlook is conservative and that with the accounts for the first quarter of 2023 more information on the bank’s potential upside could arrive.

At the beginning of 2023 and after six months of contraction, the eurozone economy indicated a marginal expansion, according to the S&P Global PMI released in the morning. Higher levels of activity were accompanied by stronger job growth with the eurozone labor market continuing to show significant resilience, but also a strengthening of confidence

L’inflation in the Eurozone it is expected to stabilize at 5.9% in 2023 and 2.7% in 2024, respectively 0.1 and 0.3 percentage points higher than expected three months ago, according to the European Central Bank’s (ECB) Survey of Professional Forecasters ), a survey of forecasting economists that board central bankers use as an indicator of market expectations.

L’Euro / US Dollar is down (-0.73%) and settles at 1.083. L’Gold it collapses to 1,865.9 dollars an ounce, leaving 2.45% on the table. Oil (Light Sweet Crude Oil) is losing ground, trading at 75.33 dollars per barrel, with a drop of 0.72%. Unchanged it spreadswhich stands at +174 basis points, with the yield of 10-year BTP which stands at 3.88%.

Among the European lists moderate contraction for Frankfurtwhich suffers a drop of 0.21%, is moving in positive territory Londonshowing an increase of 1.03%, and money up Pariswhich recorded an increase of 0.94%.

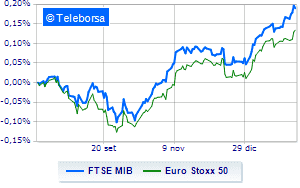

Weak session for Milanese price listwhich ends with a drop of 0.55% on FTSEMIBbreaking the positive chain of three consecutive rises, which began last Tuesday, while, on the contrary, the FTSE Italia All-Share, which increases compared to the day before, reaching 29,344 points. Slightly positive the FTSE Italia Mid Cap (+0.49%); as well as, in fractional progress the FTSE Italy Star (+0.49%).

In Piazza Affari it appears that the exchange value in today’s session it was equal to 3.74 billion euros, with an increase of no less than 978.3 million euros, equal to 35.48% compared to the previous 2.76 billion; while the volumes traded went from 0.77 billion shares in the previous session to today’s 1.36 billion shares.

At the top of the ranking of the most important titles of Milan, we find Pirelli (+3.61%), Phinecus (+2.73%), Campari (+2.43%) and Saipem (+1.62%).

The worst performances, however, were recorded on Intesa Sanpaolo, which closed down -2.93%. The negative performance of Herawhich drops by 2.79%. Nexi drops by 2.78%. Decided decline for Triadwhich marks a -2.76%.

At the top among Italian stocks a mid-cap, Mfe B (+5.96%), Carel Industries (+5.44%), Brunello Cucinelli (+4.12%) and El.En (+3.34%).

The worst performances, however, were recorded on Antares Vision, which closed at -4.18%. At a loss Luvewhich drops by 3.93%.

eight pressure IREN, with a sharp drop of 3.73%. He suffers Italmobiliarewhich shows a loss of 3.04%.