While the cost of energy weighs more and more heavily on household and business budgets, the deficit in the French trade balance continues to widen. However, the causes of this chronic deficit are above all structural, the result of the lack of competitiveness of French companies. In fact, our trade deficit is mainly built up within the European Union, where the value of currencies has little influence on price differences. Moreover, France is by far the country with the heaviest intra-European deficit, which has even been multiplied by seven in twenty years. In this sense joining the euro appears to be the best indicator of our economic weaknesses.

In general, the lack of competitiveness of a country is due either to the lower quality of its products, or to their excessive pricing. Also, the least value for money is theoretically found in the mismatch between production costs and productivity. Since raw materials (excluding taxes) have no reason to be more expensive in France than in other European countries, we must no doubt look at the other factors of production, namely labor and capital.

Insofar as the wage bill is the main expense item of companies, one may be inclined to wonder whether French employees are not overpaid relative to their European counterparts. In this case, our fellow citizens do not appear to be particularly better off than elsewhere, even though labor productivity in France is rather high. The same applies to holders of capital, their remuneration even appearing lower here than in the rest of Europe. Therefore, why think that production costs are so penalizing in France?

French social contributions are particularly high on a European scale.

© / Tax information

Taxation of labor and capital

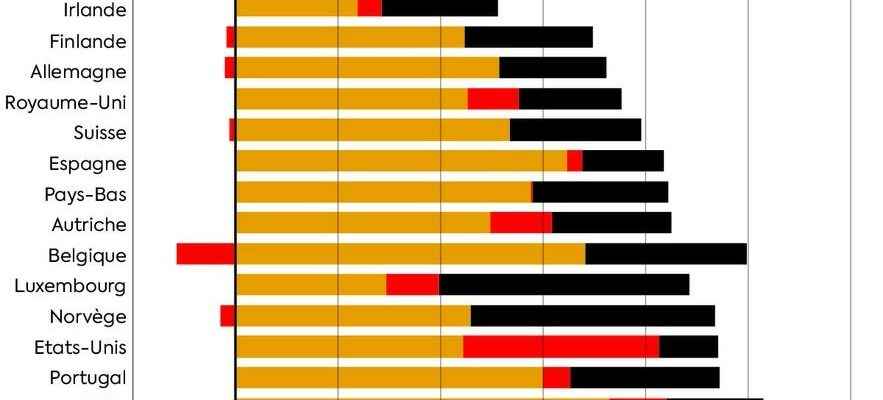

Due to the tax rate, there is a substantial mismatch between the remuneration of workers and capitalists and the effective cost of labor and capital. The graph presented here shows us how much the taxation of production factors remains particularly high for French companies compared to those of other OECD countries. Indeed, the corporate tax rate (financial and non-financial) is the second highest after that of Sweden. On their own, social contributions even constitute 18% of all company income, or 29% of work-related expenditure, the second highest rate after that of Italy.

Finally, note that the data presented here underestimate the effect of taxation on the cost of capital since they only take into account taxation on corporate profits, but must be added taxation on dividends and more. -values as well as on the capital stock. Taking these elements into account, France appears to be the European country with the highest implicit tax rate on capital income – -51% in 2019, i.e. 20 points more than in Germany, Italy or Spain.

The stakes here are considerable since the lack of competitiveness is partly the cause of the deindustrialisation of our economy, but from this stem many of the socio-geographical problems regularly cited as among the most explanatory of the political mistrust of “peripheral” populations and the flourishing of populism outside the major urban centres. This is why, in this period of rising energy costs, and while the debates on the deficit of our pension system are opening, the increase in social security contributions remains without doubt the worst of the solutions proposed.

Guillaume Bazot is an economist, lecturer at the University of Paris-VIII