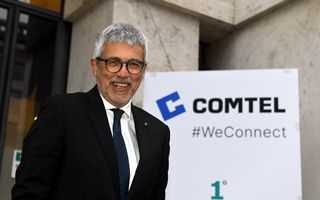

(Finance) – “The quotation pre -cooked has been long and complex, because entering the bag requires being perfect, so we are happy to have arrived and it is a moment of satisfaction for us. We have a floating that stands around the 11 % of the capital, we did a good collection of almost 5 million euros and it is all collected that it will go to M&A investments mainlyas well as to partially finance organic development, but is mainly M&A. This is a point of arrival of a long journey, but for us it is the departure: we enter the stock exchange to grow further and we have decidedly important ambitions. ” Fabio LazzeriniCEO of Com.telon the sidelines of the listing ceremony at Palazzo Mezzanotte.

https://www.youtube.com/watch?v=g9Ypzttuh4

Com.tel represents the seventh admission of 2025 on Euronext. During the placement, Com.tel collected 4.8 million euros. The floating at the time of admission is 10.98% and the capitalization of market at the IPO is equal to 44.2 million euros.

“The challenge for the iPo was a bit putting everything in place, in the sense that the company must be perfect and must be in order – explained the CEO – it was in order but there are a whole series of things we have done, in addition we complicated our life because during the listing path we also perfected the acquisition of the first goal we had of M&A, so we have had to extend the whole two diligence to the target company“.

Com.tel, for over 30 years, has been leader in the integration of ICT systems in Italy for the digital transformation of companies. Its mission is to offer consolidated skills and innovative technologies to organize global connections, making data accessible everywhere and simplifying business management.

“We still have a large path of organic growth in front of us, because the information technology market in which we work grows by an average of 4.5-4.6% year on year – underlined Lazzerini – Com.tel still has Many growth spaces both as organic growth and through acquisitions. The acquisitions are very targeted: either we buy companies that do the same work ourselves but broaden the technological competence we have – as is the case of the first acquisition that we have made – or extend the geographical area, or in complementary sectors such as IoT, cyber security and artificial intelligence “.

“We have a very strong competence in what we tried to synthesize in the hashtag that is under our logo, which is this” Weconnect ” – said the manager – when we started this path – I entered the company a year ago – We started the path with the president Davide Cilli and the vice -president Carlo Nardello to bring the company to the stock exchange. Information Technology, Cyber Security, Network and Security – But what does it distinguish us? One thing that characterizes us a lot is this ability to connect anything: We connect through fiber, 5g, radio bridges, satellites, anything, be they people, teams or even devices with the whole world of IoT – for example – with the sensors that are in Smart City or in the projects of the aqueducts “.

“This is our intrinsic ability, it is a value that is based on the competence of people who are 100% of the company’s assets, also because we have no proprietary hardware owners – he added – We have a great competence and this turns into a great loyalty of customers: the first 20 customers of Com.Tel are customers who repeat purchases with us for 10-15 years now, so they are satisfied customers and who remain precisely that find a great competence in us ”