(Finance) – Rise for Coinbase Global,which changes hands in strong gains, surpassing the previous values by 6.87%.

The cryptocurrency trading platform has announced a restructuring plan that plans to cut 950 jobs. Coinbase, which had around 4,700 employees at the end of September, already cut 18% of its workforce in June citing the need to manage costs. The title shoots up by 4.5%. The company continues to expect adjusted EBITDA for the full year ended December 31, 2022 to be within the negative $500 million loss limit the company previously disclosed.

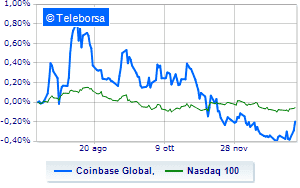

Comparatively on a weekly basis, the trend of Coinbase Global, shows a more marked trend than the trendline NASDAQ 100. This demonstrates the greater propensity of investors to buy towards Coinbase Global, compared to the index.

The medium-term technical status of Coinbase Global, remains negative. In the short term, however, we see an improvement in bullish strength, with the curve meeting the first resistance area at USD 42.95, while the supports are estimated at 38.29. The technical implications lean in favor of a new bullish starting point with a target estimated probably in the 47.61 area.