The measure was eagerly awaited. China announced, this Sunday, August 27, the halving of the tax on stock market transactions. Objective: to restore confidence in the world’s second largest stock market, against a backdrop of economic slowdown. This reduction, which will be effective from Monday, is the first since 2008.

“In order to boost the capital market and boost investor confidence, the stamp duty on securities transactions will be halved from August 28,” the finance ministry and administration said in a joint statement. responsible for taxation. The tax was until now 0.1%.

Lately, mainland Chinese stock exchanges have been rocked by the poor health of the national economy with high youth unemployment, declining exports and a real estate debt crisis. Recently, the situation of the promoter Evergrande, over-indebted, has tarnished the Chinese image a little more. He also indicated on Sunday that he had widened his losses in the first half, despite a slight drop in total debt. Its net losses for the January-June period amounted to 33 billion yuan ($4.53 billion), according to a statement posted on the Hong Kong Stock Exchange’s website.

If his descent into hell is emblematic of the real estate crisis in China, he is not the only one to experience difficulties. Country Garden, long deemed financially sound, was unable at the beginning of August to repay two interest on loans.

“A point of no return”

The CSI 300 index of major capitalizations on the Shanghai and Shenzhen stock exchanges fell about 4% in 2023, after two consecutive years of decline, according to the financial information agency. Bloomberg. This fall is partly explained by the lack of a major economic recovery after the Covid-19 pandemic, with the authorities still reluctant to initiate a real recovery plan. “It is now clear that the first quarter of 2020, marked by the start of the pandemic, represented a point of no return for the Chinese economy”, recently analyzed economist Adam Posen in L’Express.

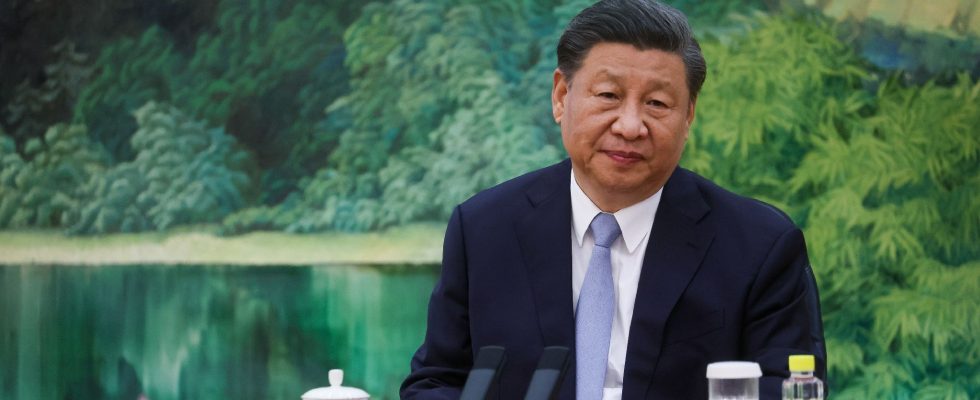

While China’s economic lights are red, observers navigate by sight, for lack of access to official data. “A recent study showed that since Xi Jinping came to power, the number of data updated by the National Bureau of Statistics has been reduced by three!” lamented in our columns François Rimeu, strategist of the management company La Française AM. The latest example to date is the suspension of the publication of the unemployment rate for young people aged 16 to 24. According to the last published report, it was around 21%. An organized vagueness that scares away investors.

In this context, the government’s objective of economic growth of around 5% seems difficult to sustain. Especially since the Chinese president did not seem ready to take major measures. Until this Sunday? With the announcement of the tax on stock market transactions, the government aims to bring back investors who have lost confidence in Chinese assets. This decline should generate significant transactions from Monday when quotations resume.