At the Olympic Games, it is the metal that is won if all goes well. On the markets, it is prized… when all goes badly. Léon Marchand, Teddy Riner and Pauline Ferrand-Prévot, for their part, can smile. The 6 grams of gold plated on their Olympic medals – which are also made of silver – have never been worth so much. The ounce, a reference measure equivalent to 31 grams, broke a new record on Monday, August 19 and now exceeds $2,500. It weighed less than $2,000 a year ago. A dark omen?

Usually, the price of gold has two drivers. A weak dollar, which pushes investors to look for another safe haven asset to protect their financial portfolios. And low real interest rates – that is, excluding inflation – which we see when the economy is struggling. Bullion does not provide its holder with a return. No dividend, like a stock. No coupon, like a bond. Even less rent, like real estate. Nothing. All the investor can hope for is that its value will rise. Or at least that it will not fall in times of crisis, when all other financial assets are falling. It is credited with a virtue of “diversification”: rather than putting all your eggs in one basket, nestle one or two in the “gold” category.

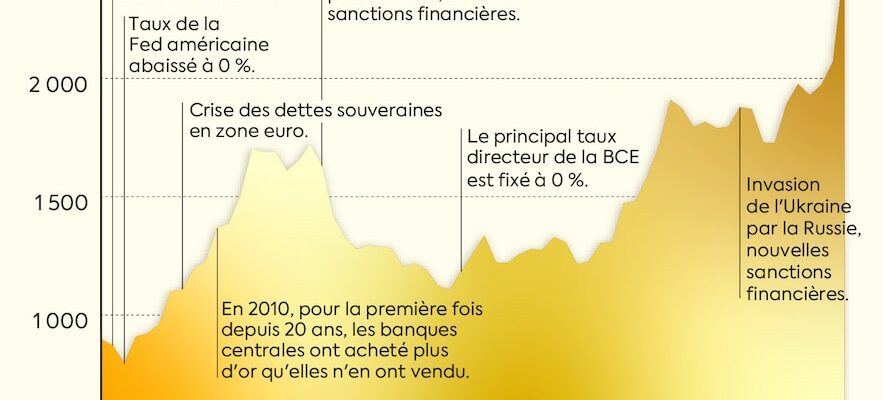

The price of gold has nearly tripled since the 2008 financial crisis.

© / The Express

An unusual fever

However, recently, the compass seems to be out of whack. The dollar is strong, rates are high… And the price of the yellow metal is rising despite everything. So we must look for the reasons for the fever elsewhere than in traditional factors. All over the world, in fact: from China to Kazakhstan, via Turkey and Iraq… It is the central banks of these countries which, through their purchases of gold, are participating in the rise in the price of an ounce. “Since 2022, especially, with more than 1,000 tonnes acquired each year, record volumes, out of a total annual demand worldwide of 4,500 to 5,000 tonnes”, underlines the commodities expert Florent Pelé, of Société Générale CIB. The central banks therefore represented more than 20% of demand, also driven by jewellery, investment products, coins and ingots…

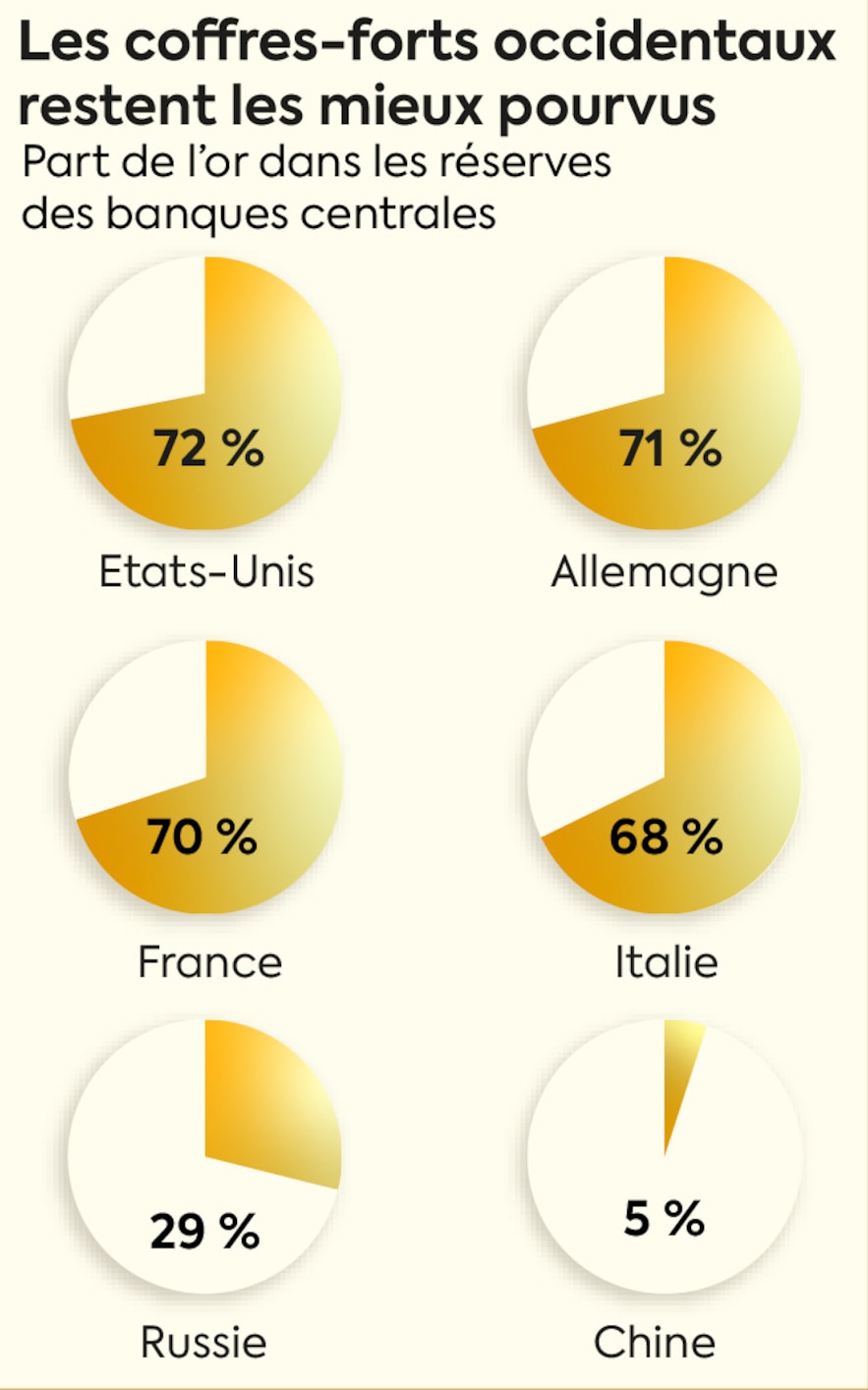

At first glance, emerging countries are the most active, as developed economies have historically had well-stocked reserves. This is a legacy of the gold standard era, when major currencies were convertible into gold at the issuing central bank. Since the 1970s, the yellow metal has lost its monetary value and developed countries have no reason to strengthen their reserves. The Banque de France, for example, with its 2,437 tonnes of gold stored 27 metres underground in the heart of Paris, claims not to intend to increase or decrease this stock “in the coming years”. Conversely, nearly 40% of emerging countries’ central banks plan to increase the share of their gold reserves in the next twelve months.

Western safes remain the best equipped.

© / The Express

Distrust of the financial system

To understand this phenomenon, Florent Pelé went further in the analysis, combing the figures through three criteria: the wealth of the country – GDP per capita assessed by the World Bank –, the degree of freedom – measured by the Atlantic Council – and the existence or not of a military alliance with the United States. It is on the basis of these last two indicators that the results are the most telling. “Since 2008 and the financial crisis, countries classified as not free have bought 2.4 times more gold than other countries. And those that do not have a military alliance with the United States, 4.2 times more, calculated the specialist. These States are concerned with reducing their exposure to the dollar, out of distrust of the global financial system.” Unlike a debt product, gold has the advantage of not presenting a credit risk: no default by a partner will reduce its value to nothing.

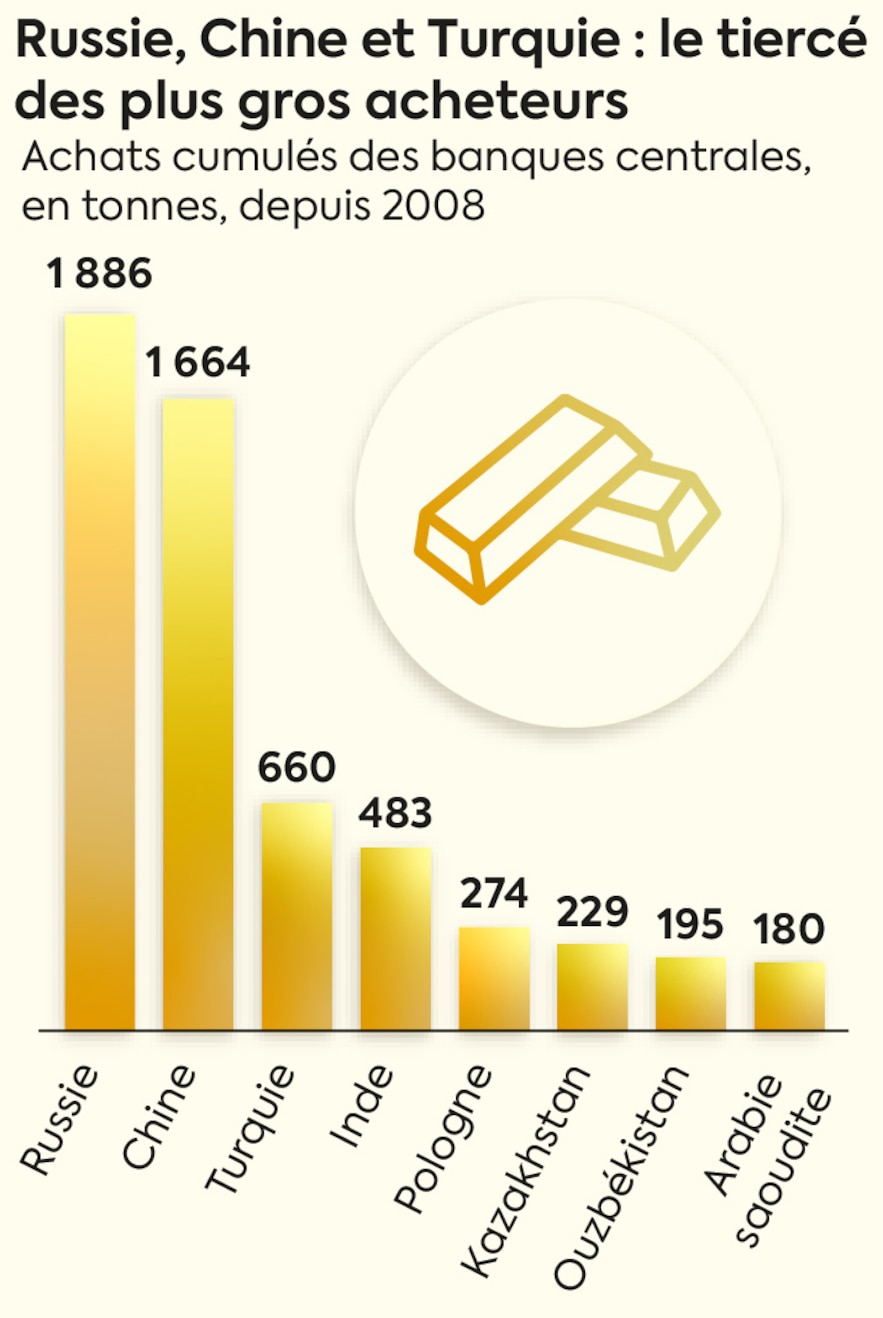

Beyond economic motivations, and the role of safe haven that we associate with this precious metal in the event of a crisis, the geopolitical dimension therefore plays a growing role, reinforced by the financial sanctions imposed by the United States on its political adversaries. “Over the last fifteen years, the three biggest buyers of gold are Russia, China and Turkey. Countries that have all suffered or are at risk of suffering sanctions, points out Daniel McDowell, professor of political science at Syracuse University (New York State). Russian purchases, for example, had significantly accelerated after the annexation of Crimea in 2014 and the sanctions that followed.”

Unlike dollar bank accounts, gold has this trump card: it is a real, physical asset that can be kept on its territory. Out of reach of the American authorities in the event of seizure. Such a treasure can prove useful when the country’s economic situation becomes critical. Some have thus been able to use their ingots to “survive the sanctions”, relates the academic, like Nicolas Maduro, financially cornered: “With the help of Russia, Venezuela sent gold by plane to Iran, Uganda and the United Arab Emirates in exchange for cash in euros.”

In addition to this underlying trend of de-dollarization, reinforced since the war in Ukraine, more cyclical elements have recently been added. In March and April, Société Générale’s research teams identified unusual movements when the price of an ounce soared by 17% in a few weeks without the variation in American rates or central bank transactions justifying such a move. “rally”. They identified the cause: Chinese investors, both individuals and professionals, were looking for ways to counter the ill winds blowing through their economy. Capital controls preventing investment abroad, the real estate crisis, the stock market crash, rock-bottom interest rates… Gold, traditionally very popular in China, has established itself as an alternative investment of choice.

Russia, China and Türkiye: the trio of biggest buyers.

© / The Express

When Trump Triggers Gold Buying

In the United States, too, gold investment flows are influenced by domestic events, against a backdrop of worrying deterioration in public finances. Over a thirty-year horizon, American debt could represent 166% of GDP, compared to just under 100% estimated at the end of 2024. In this respect, the policy of the winner of the November presidential election will prove crucial, as investors are well aware. “We observe a correlation between investors’ long positions and the probability of a Donald Trump victory,” notes Florent Pelé. According to the weekly report from the federal agency Commodity Futures Trading Commission (CFTC), they had increased in the wake of the attempted assassination of the Republican candidate in July, an episode that had benefited him in the polls. Conversely, when Joe Biden gave way to Kamala Harris, thus boosting, according to the polls, the Democratic camp’s chances, these positions were partly liquidated. So a new Trump term would be riskier than the election of the current vice president?

Clearly, savvy traders have listened carefully to the respective platforms of the two parties. They conclude that a return of Donald Trump to the White House would mean an even faster surge in public debt than the current trend. “The main reason is that the tax cuts introduced by his administration in 2017 are set to end next year. And they are more likely to be renewed if he is re-elected,” explains Florent Pelé. Not to mention that Washington’s foreign policy is also likely to affect the price of the metal. The world’s leading military power does not have the right to make the slightest misstep. If peace recedes, gold rises. A new parameter that investors will have to get used to.

.