(Finance) – Positive session for Chevrons, which rose by 3.14%, thanks to the promotion from HSBC. The experts of the study office have revised upwards the judgment on the title of the US oil giant, bringing it to “buy” from the previous “hold”.

Chevron yesterday announced that it has entered into an agreement to acquire all of the outstanding shares of PDC Energy in an all-stock transaction valued at $6.3 billion, or $72 per share.

“PDC’s attractive and complementary assets strengthen Chevron’s position in key US manufacturing regions,” said Mike Wirth, Chevron president and chief executive officer. “This transaction enhances all important financial measures and enhances Chevron’s goal of safely deliver higher yields and lower carbon emissions.”

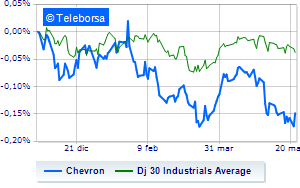

The trend of US oil giant shows a trend in line with that of the Dow Jones. This situation classifies the security as a low alpha value asset that does not generate any added value, in terms of return compared to the reference index.

Analyzing the scenario of oil giant of San Ramon there is an extension of the bearish phase at the test of the USD 154.8 support. First resistance at 158.6. Expectations are for a continuation of the negative line towards new lows at 152.4.