(Finance) – The title is moving downwards Chevrons which trades at a loss of 4.06% on previous values.

The American oil giant has announced a buyback plan worth $75 billion and increased dividends. But, in the fourth quarter of last year, Chevron reported EPS of $4.09, below the $4.38 per share consensus expectation.

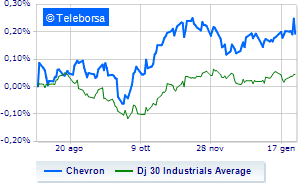

The technical scenario seen in one week of the title compared to the index Dow Jonesshows a slowdown in the trend of US oil giant compared toamerican indexmaking the stock a potential target for investors to sell.

At present the short-term scenario of the oil giant of San Ramon shows a decisive climb with a target identified at 183.6 USD. In the event of a temporary physiological correction, the most immediate target is seen at 177.3. However, expectations are for a rise in the curve to the top of 189.9.