(Finance) – Wall Street continues the session with caution on the eve of the numbers on American inflation, the last before the Federal Reserve’s verdict on rates next week. This is the consumer price index expected for tomorrow, Wednesday, and the producer price index (Thursday) which should record an increase in the month of August, in the wake of the increase in energy prices.

Other data on the calendar this week will shed light on retail sales, which are expected to fall as consumers grapple with the consequences of rising rates, to their highest level since 2007.

Insiders estimate that the Federal Reserve will keep the cost of money unchanged, postponing any new moves until next meetings.

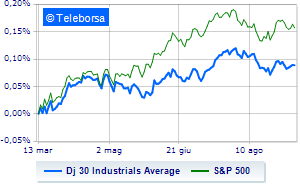

The Dow Jones shows a fractional gain of 0.53%, while, on the contrary, theS&P-500 (New York), which is positioned at 4,486 points, close to previous levels. Under parity the Nasdaq 100, which shows a decline of 0.42%; almost unchangedS&P 100 (-0.13%).

The sectors highlighted on the North American S&P 500 list power (+2.39%) e financial (+1.40%). At the bottom of the ranking, the greatest declines occur in the sectors informatics (-0.96%) e telecommunications (-0.46%).

At the top of the rankings American giants components of the Dow Jones, Goldman Sachs (+2.90%), Walgreens Boots Alliance (+2.61%), Walt Disney (+2.04%) e Chevron (+1.94%).

The steepest declines, however, occur at Procter & Gamblewhich continues the session with -1.43%.

Disappointing Microsoftwhich lies just below the levels of the day before.

Slack Applewhich shows a small decrease of 1.13%.

Modest descent for Salesforcewhich drops a small -0.77%.

Between best performers of the Nasdaq 100, Diamondback Energy (+2.61%), Walgreens Boots Alliance (+2.61%), Paypal (+2.41%) e AirBnb (+2.37%).

The strongest sales, however, occur at Adobe Systemswhich continues trading at -3.07%.

The negative performance of Illuminatewhich falls by 2.99%.

Datadog drops by 2.91%.

Decline decided for DexComwhich marks -2.88%.