(Tiper Stock Exchange) – Cautious session for European markets, after yesterday’s crash on fears of high long-term interest rates. Today the focus is on the change in US payrolls for the month of June which will be communicated at 2:30 pm by the Department of Labor. Yesterday, ADP’s June estimate of private non-farm payrolls surprised on the upside, up 497k from 267k in May.

On the European macroeconomic frontGermany’s industrial production posted a slight correction in May (below consensus expectations), France’s current account balance showed a more-than-expected deficit decline, and Italian retail sales signaled a cyclical increase in value and in volume in May.

As far as monetary policy is concerned, Christine Lagardepresident of the European Central Bank (ECB), said that a simultaneous increase in margins and wages “it would fuel inflation risks” and “we would not stand idly by in the face of those risks”.

L’Euro / US Dollar remains substantially stable at 1.088. L’Gold the session continued at the previous levels, reporting a variation of +0.2%. Basically stable oil marketwhich continues the session at the levels seen on the eve with oil (Light Sweet Crude Oil) trading at 71.98 dollars per barrel.

Unchanged it spreadswhich stands at +167 basis points, with the yield of the 10-year BTP which stands at 4.30%.

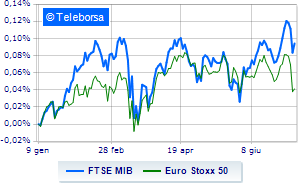

Among the indices of Euroland little moved Frankfurtshowing a -0.17%, undertone London showing a filing of 0.47%, and essentially unchanged Pariswhich reports a moderate -0.07%.

It moves fractionally down Business Squarewith the FTSEMIB which is leaving 0.21% on the ground, while, on the contrary, it moves around parity FTSE Italia All-Share, which continues the day at 29,480 points. Almost unchanged FTSE Italia Mid Cap (+0.07%); slightly below parity the FTSE Italy Star (-0.2%).

Among the best Blue Chips of Piazza Affari, well bought Saipem, which marks a sharp rise of 1.83%. Positive balance for Mediolanum Bank, which boasts an increase of 1.25%. Basically tonic BPM desk, which recorded a capital gain of 1.07%. Moderate income for Tenariswhich increased by 1.05%.

The strongest declines, however, occur on amplifier, which continues the session with -2.24%. Bad sitting for Triad, which shows a loss of 1.62%. Under pressure Inwit, which shows a drop of 1.53%. Disappointing DiaSorinwhich lies just below the levels of the eve.

Between best stocks in the FTSE MidCap, Saphilus (+3.19%), Ariston Holding (+1.85%), Webuild (+1.40%) and Tod’s (+1.34%).

The strongest sales, on the other hand, show up Antares Vision, which continues trading at -1.56%. Slide Buzzi Unicem, with a clear disadvantage of 1.55%. Slack MFE B, which shows a small decrease of 1.20%. Modest descent for CIRwhich drops a small -1.15%.