(Finance) – A day marked by caution for European stock prices, after data on the labor market in the United States showed the creation of 150 thousand jobs in the month of September, less than expected by analysts. The data is important to understand how the Federal Reserve will proceed with interest rates at the end of the year. According to insiders, it could help push the American central bank to adopt a less aggressive policy.

In the meantime, the quarterly season continues, from one side of the ocean to the other.

On the currency market, theEuro / US Dollar continues trading with a fractional gain of 0.37%. Slight increase ingold, which rises to 1,990.4 dollars an ounce. Crude Oil (Light Sweet Crude Oil) shows a fractional gain of 0.68%.

It goes down spreadsettling at +180 basis points, with a drop of 4 basis points, while the 10-year BTP reports a yield of 4.52%.

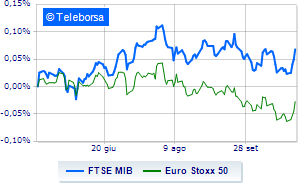

Among the Euroland indices Frankfurt is stable, reporting a moderate +0.17%, a cautious trend for Londonwhich shows a performance of -0.13%, and has changed little Paris, which shows -0.12%. The Milanese price list shows a timid gain, with the FTSE MIB which is achieving a +0.35%, continuing the series of five consecutive increases that began last Monday; along the same lines, little leap forward for the FTSE Italia All-Sharewhich reaches 30,439 points.

At the top of the ranking of the most important titles of Milan, we find Nexi (+4.99%) on the continuing rumors about an upcoming share restructuring led by private equity funds. Good also Fineco (+3.26%), DiaSorin (+2.19%) e Intesa Sanpaolo (+1.74%), the latter today released its financial statement results which showed a profit for the 9 months of 6.12 billion euros and an interim dividend doubled.

The worst performances, however, are recorded on Tenariswhich gets -1.60%: the analysts expressed their opinion the day after the accounts.

Telecom Italia drops by 1.58% on the eve of the Board of Directors meeting to examine and decide on the offers received from KKR.

Slow day for Unicreditwhich marks a decline of 1.04%.

Small loss for Herawhich trades at -0.87%.

At the top among Italian shares a mid-cap, MFE A (+3.80%), Anima Holding (+3.78%), De’ Longhi (+3.64%) e Illimity Bank (+3.00%).

The strongest sales, however, occur at Technoprobewhich continues trading at -1.31%.

He hesitates Ferrettiwhich lost 1.19%.

Basically weak De Nora Industrieswhich recorded a decline of 1.18%.

It moves below parity Buzzi Unicemhighlighting a decrease of 1.07%.