(Tiper Stock Exchange) – The main Euroland stock exchanges move in no particular order while among investors thewaiting for Federal Reserve minutes which will be released in the evening. Insiders are betting on a slowdown in monetary tightening after words from the Fed official, Loretta Master which has declared its intention to evaluate a reduction in the entity of the increases in the cost of money. In the meantime, comforting indications have arrived from the PMI indices of the Eurozone, with signs of a slowdown in prices. There is also anticipation for the ECB’s monetary policy minutes.

On the currency market, theEuro / US Dollar, which continues the session on the previous day’s levels and stops at 1.032. L’Gold maintains substantially stable position at 1,738.7 dollars an ounce. Light Sweet Crude Oil shows a fractional gain of 0.79%.

Go back down it spreadssettling at +187 basis points, with a drop of 4 basis points, while the yield on the 10-year BTP stands at 3.86%.

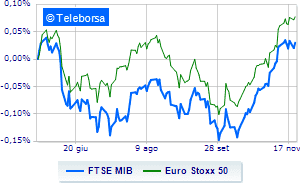

In the European stock market scenario moves modestly up Frankfurthighlighting an increase of 0.07%, positive balance for London, which boasts an increase of 0.52%; neglected Paris, which remains glued to the previous levels. Piazza Affari moves fractionally downwards, with the FTSEMIB which is leaving 0.23% in the crowd.

At the top of the ranking of the most important titles of Milan, we find Saipem (+5.54%), Prysmian (+2.30%), ENI (+1.81%) and Mediolanum Bank (+0.76%).

The strongest sales, on the other hand, show up A2Awhich continues trading at -3.00%.

Under pressure Is in thewith a sharp drop of 1.94%.

He suffers Pirelliwhich shows a loss of 1.66%.

Moderate contraction for Stellantiswhich suffers a drop of 1.10%.

Between best stocks in the FTSE MidCap, Saras (+5.24%), Salcef Group (+1.50%), wiit (+1.31%) and Tod’s (+1.26%).

The strongest sales, on the other hand, show up Intercoswhich continues trading at -2.21%.

Prey of sellers Sesawith a decrease of 1.68%.

Undertone Brunello Cucinelli showing a filing of 1.15%.

Disappointing Tinextawhich lies just below the levels of the eve.

Among the data relevant macroeconomics:

Wednesday 11/23/2022

10am European Union: Manufacturing PMI (exp. 46 points; previous 46.4 points)

10am European Union: Composite PMI (expected 47 points; previous 47.3 points)

10am European Union: PMI services (expected 48 points; previous 48.6 points)

2.30pm USA: Durable goods orders, monthly (exp. 0.4%; prev. 0.4%)

2.30pm USA: Initial Jobless Claims, Weekly (Expected 225K; Previously 222K).