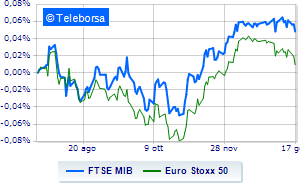

(Finance) – Little moved The FTSE MIBlike the main European stock exchanges, with investors wondering about the next steps of the central banks, after, the day before, the president of the ECB, Christine Lagarde, suggested a rate cut “probably in the summer,” dampening hopes of easing as early as the spring. In the next few hours, Eurotower’s number one will speak again from Davos. Geopolitical tensions and fears of the Red Sea effect on energy prices remain in the background.

On the currency market, theEuro / US Dollar the session continues at the levels of the day before, reporting a change of +0.12%. L’Gold shows a timid gain, with an increase of 0.25%. The oil market is substantially stable, continuing the session at the levels of the day before with oil (Light Sweet Crude Oil) trading at 72.95 dollars per barrel.

Slight improvement of spreadwhich drops to +160 basis points, with a drop of 3 basis points, while the yield on the 10-year BTP stands at 3.89%.

In the European stock market scenario positive balance for Frankfurtwhich boasts an increase of 0.29%, a cautious trend for Londonwhich shows a performance of -0.1%, and is substantially toned Paris, which records a capital gain of 0.45%. Slight increase for the Milan Stock Exchange, which shows on FTSE MIB an increase of 0.35%; along the same lines, the FTSE Italia All-Share advances fractionally, reaching 32,302 points.

Between best performers of Milan, highlighted Moncler (+2.89%), STMicroelectronics (+2.08%), BPER (+2.01%) e Unicredit (+1.41%).

The steepest declines, however, occur at Amplifonwhich continues the session with -3.15%.

In red Campariwhich highlights a sharp decline of 1.75%.

Slow day for Leonardowhich marks a decline of 1.35%.

Small loss for Telecom Italiawhich trades at -1.19%.

Between best stocks in the FTSE MidCap, Banca Popolare di Sondrio (+3.50%), Danieli (+2.50%), Ferragamo (+1.99%) e Tod’s (+1.71%).

The steepest declines, however, occur at Lottomatica Groupwhich continues the session with -2.72%.

The negative performance of Webuildwhich falls by 2.55%.