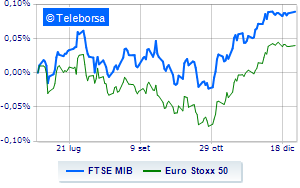

(Finance) – Cautious session for the main stock exchanges of the Old Continent. There is also uncertainty in the Milan market which is positioned on the parity line. Stock lists are awaiting US data, arriving in the afternoon, in particular on the labor market with unemployment benefit claims and, of the opening of Wall Street:

On the currency market, little movedEuro / US Dollar, which trades on the day before at 1.112. L’Gold it is essentially stable at 2,073.9 dollars an ounce. Bad day for oil (Light Sweet Crude Oil), which continues trading at 73.06 dollars per barrel, down 1.41%.

On equality, yes spreadwhich remains at +159 basis points, with the yield on the 10-year BTP standing at 3.52%.

Among the main European stock exchanges little moved Frankfurtwhich shows -0.13%, essentially unchanged Londonwhich reports a moderate -0.1%, and moderate contraction for Paris, which suffers a drop of 0.34%. No significant change for the Milanese price list, with the FTSE MIB which stands at 30,407 points on the day before; on the same line, remains at the starting line FTSE Italia All-Share (Business Square), which is positioned at 32,536 points, close to previous levels.

Between best Italian shares large cap, small steps forward for Pirelliwhich marks a marginal increase of 0.97%.

Moderately positive day for Leonardowhich rises by a fractional +0.57%.

Sitting without momentum for Ivecoreflecting a moderate increase of 0.57%.

The strongest sales, however, occur at Herawhich continues trading at -0.87%.

Undertone BPER which shows a reduction of 0.79%.

Disappointing BPM deskwhich lies just below the levels of the day before.

Among the protagonists of the FTSE MidCap, LU-VE Group (+1.09%), Rai Way (+0.99%), De’ Longhi (+0.92%) e Fincantieri (+0.91%).

The worst performances, however, are recorded on Carel Industrieswhich obtains -2.19%.

Under pressure MortgagesOnlinewith a sharp decline of 1.84%.

He suffers Replywhich shows a loss of 1.81%.

Prey for sellers D’Amicowith a decrease of 1.78%.