(Finance) – The main European stock exchanges are moving cautiously, confirming the caution shown at the start of the session, the last one of the week. Easing inflation in the US has fueled hopes that the Federal Reserve’s rate hike path may be nearing its end.

Meanwhile, the season of quarterly reports has begun, which will give indications on the trend of economic growth. The numbers of the big American banks started to arrive today, results above analysts’ expectations. These are JPMorgan, Wells Fargo, Citi and the fund giant Blackrock.

On the foreign exchange market, theEuro / US Dollar remains substantially stable at 1.123. L’Gold it is essentially stable at 1,957.8 dollars an ounce. Weak session for Light Sweet Crude Oil, trading down 0.02%.

Slightly increase it spreadswhich reaches +169 basis points, with a slight increase of 2 basis points, with the yield on the 10-year BTP equal to 4.14%.

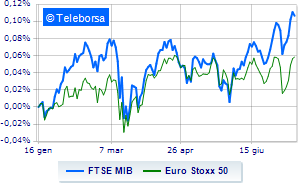

Among the main European Stock Exchanges modest descent for Frankfurtwhich drops a small -0.23%, nothing done for London, which changes hands on parity; composed Paris, which grows by a modest +0.25%. No significant changes for the Milanese price list, with the FTSEMIB which stands on the previous day’s values at 28,754 points; on the same line, remains at the starting line the FTSE Italia All-Share (Business Square), which stands at 30,811 points, close to the previous levels.

Between best Italian stocks large-cap, good performance for MPS Bankwhich grows by 2.28%.

sustained Phinecuswith a decent gain of 1.64%.

Modest performance for Registerwhich shows a moderate increase of 1.17%.

Resistant Telecom Italywhich marks a small increase of 1.11%.

The strongest sales, on the other hand, show up ENIwhich continues trading at -1.31%.

Thoughtful Nexiwith a fractional decline of 1.12%.

He hesitates Is in thewith a modest decline of 0.95%.

Slow day for A2Awhich marks a drop of 0.95%.

Between best stocks in the FTSE MidCap, believe (+4.42%), Cementir (+2.70%), Cembre (+1.69%) and Saphilus (+1.60%).

The worst performances, however, are recorded on De Nora Industrieswhich gets -2.83%.

Prey of sellers Datalogicwith a decrease of 1.76%.

Small loss for El.Enwhich trades at -1.25%.

He hesitates Maire Tecnimontwhich drops 0.97%.