(Finance) – Cautious session for the main stock exchanges of the Old Continent, in a session once again marked by the arrival of the quarterly reports. Investors’ attention also remains focused on the indications coming from central banks on rate cuts following the words of the president of the Fed, Jerome Powell.

Uncertainty also exists on the Milan square which is positioned on the parity line where the rally stands out MPS which closed 2023 with a net profit of 2 billion euros and returns to the dividend after 13 years, two years ahead of the plan target.

On the currency market, theEuro / US Dollar it is essentially stable and stops at 1.077. L’Gold it is essentially stable at 2,034.6 dollars an ounce. Slight increase in oil (Light Sweet Crude Oil) which rises to 73.78 dollars per barrel.

Consolidates the levels of the day before spreadsettling at +159 basis points, with the yield on the 10-year BTP standing at 3.84%.

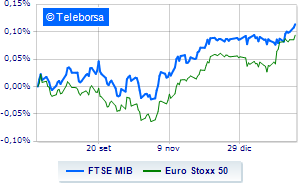

Among the European price lists remains close to parity Frankfurt (-0.19%), flat Londonwhich holds parity, and without ideas Paris, which does not show significant changes in prices. Piazza Affari continues the session at the levels of the day before, reporting a change of +0.18% on FTSE MIB; on the same line, the FTSE Italia All-Sharewith prices positioned at 33,308 points.

Among the best Blue Chips of Piazza Affari, excellent performance for MPS Bankwhich records an increase of 5.60%.

Good performance for Stellantiswhich grows by 2.49%.

Supported Ferrariwith a decent gain of 1.94%.

Substantially toned DiaSorinwhich recorded a capital gain of 1.43%.

The steepest declines, however, occur at Leonardowhich continues the session with -2.14%.

It slides Intesa Sanpaolowith a clear disadvantage of 1.81%.

It moves below parity Interpumphighlighting a decrease of 1.35%.

Moderate contraction for Saipemwhich suffers a decline of 1.31%.

At the top among Italian shares a mid-cap, OVS (+2.37%), Ariston Holding (+1.38%), Carel Industries (+1.36%) e Tod’s (+1.26%).

The strongest sales, however, occur at D’Amicowhich continues trading at -2.43%.

In red Anima Holdingwhich highlights a sharp decline of 1.95%.

Undertone Zignago Glass which shows a reduction of 1.47%.