(Finance) – European stock lists in no particular order this morning, taking a breather after the rally the day before, while reflecting on what emerged from the Fed minutes, ie maintaining a restrictive political stance.

Meanwhile, from the macroeconomic front, indications above the estimates were received from the Chinese PMI relating to the services sector and from the data that measures the confidence of Japanese consumers. Good news also from Germany, where the trade balance surplus grew more than consensus. The focus now shifts to Euroland producer prices and Italian inflation, both arriving in the morning. From the USA, expected in the afternoon: the ADP estimate on the US private sector payroll balance, the new jobless claims and the balance of trade.

On the currency market, theEuro / US Dollar, which trades on the previous day’s values of 1.062. Slight drop ingold, which drops to $1,849.5 an ounce. Sharp increase in oil (Light Sweet Crude Oil) (+2.21%), which reaches 74.45 dollars per barrel.

Consolidate the levels of the eve lo spreadssettling at +199 basis points, with the yield on the ten-year BTP standing at 4.30%.

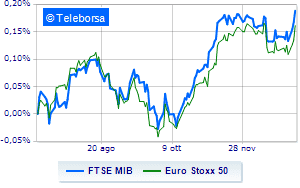

Among the European lists moderate contraction for Frankfurtwhich suffers a drop of 0.29%, moves modestly higher London, showing an increase of 0.36%; undertone Paris showing a filing of 0.48%. Piazza Affari moves fractionally downwards, with the FTSEMIB which is leaving 0.22% on the floor, while, on the contrary, the FTSE Italia All-Sharewith the quotations standing at 26,873 points.

Between best Italian stocks large-cap, positive balance sheet for Tenariswhich boasts an increase of 1.16%.

Basically tonic Saipemwhich recorded a capital gain of 0.96%.

Moderate income for CNH Industrialwhich advanced by 0.76%.

Small steps forward for ENIwhich marks a marginal increase of 0.66%.

The strongest declines, however, occur on Herawhich continues the session with -2.19%.

Prey of sellers Prysmianwith a decrease of 1.70%.

Disappointing DiaSorinwhich lies just below the levels of the eve.

Slack Triadwhich shows a small decrease of 1.22%.

Between best stocks in the FTSE MidCap, Piaggio (+2.30%), Fincantieri (+2.01%), De’Longhi (+1.72%) and De Nora Industries (+1.69%).

The worst performances, however, are recorded on IRENwhich gets -1.89%.

They focus their sales on CIRwhich suffers a drop of 1.69%.

Sales on Luvewhich records a drop of 1.52%.

Modest descent for SOLwhich drops a small -1.42%.

Between macroeconomic quantities most important:

Thursday 05/01/2023

02:45 China: Caixin Services PMI (previously 46.7 points)

08:00 Germany: Trade balance (expected 7.5 billion euros; previous 6.9 billion euros)

11:00 am European Union: Production prices, monthly (exp. -0.9%; previous -2.9%)

11:00 am European Union: Production prices, annual (expected 27.5%; previous 30.8%)

11:00 am Italy: Consumption prices, monthly (expected 0.1%; previous 0.5%).