(Tiper Stock Exchange) – Slight increase for the FTSE MIB, on a par with the main European stock exchanges, who recovered after a negative start in the wake of yesterday’s crash. Today the focus is on the change in US payrolls for the month of June, released by the Department of Labor. Yesterday, ADP’s June estimate of private non-farm payrolls surprised on the upside, up 497k from 267k in May.

On the European macroeconomic frontGermany’s industrial production posted a slight correction in May (below consensus expectations), France’s current account balance showed a more-than-expected deficit decline, and Italian retail sales signaled a cyclical increase in value and in volume in May.

As far as monetary policy is concerned, Christine Lagarde, president of the European Central Bank (ECB), said a simultaneous increase in margins and wages “would fuel inflation risks” and “we would not stand idly by in the face of those risks”. The vice president Louis de Guindos he said “services inflation, and labor costs in particular, need to be closely monitored, as they are now a major driver of overall inflation.”

No significant change for theEuro / US Dollar, which trades on the previous day’s values of 1.089. Seat up slightly for thegold, advancing to $1,917.8 an ounce. Sitting on parity for Light Sweet Crude Oil, which stands at $71.99 per barrel.

On the levels of the eve it spreadswhich remains at +167 basis points, with the yield of the 10-year BTP which stands at 4.31%.

In the European stock market scenario small step forward for Frankfurtwhich shows a progress of 0.46%, falters Londonwhich yields 0.21%, and composed Pariswhich grows by a modest +0.52%.

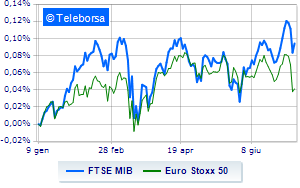

Business Square continue the session with a fractional gain on the FTSEMIB by 0.56%, reversing the trend from the series of three consecutive declines, which began last Tuesday; along the same lines, the FTSE Italia All-Share it advances fractionally, reaching 29,690 points. Just above parity the FTSE Italia Mid Cap (+0.55%); as well as, fractional earnings for the FTSE Italy Star (+0.33%).

Between best Italian stocks large-cap, exploit by Iveco, which shows an increase of 4.16%. sustained BPER, with a decent gain of 1.95%. Good insights on BPM desk, showing a large lead of 1.62%. Well set up Tenariswhich shows an increase of 1.58%.

The worst performances, however, are recorded on amplifier, which gets -1.72%. Basically weak Triad, which recorded a decrease of 0.90%. It moves below parity Inwitshowing a decrease of 0.81%.

At the top of the mid-cap rankings from Milan, Ariston Holding (+2.13%), Carel Industries (+1.92%), Danieli (+1.90%) and Bff Bank (+1.75%).

The worst performances, however, are recorded on Saras, which gets -1.97%. Moderate contraction for Antares Vision, which suffers a drop of 1.40%. Undertone Caltagirone SpA showing a filing of 1.03%. Disappointing Aceawhich drops by 0.96%.