(Finance) – European stock markets close the week on a positive noteeven if today they recorded a mixed session, however supported by the data on the US labor market for the month of October, which strengthen the belief in the end of rate rises by the Federal Reserve.

On the macroeconomic front, Eurostat announced this morning that in the Eurozone in September the unemployment rate recorded a marginal increase to 6.5% from the previous 6.4% (historic low), against expectations of stability. Similar trend also in Italy, Istat reported a slight increase to 7.4% from the previous 7.3%.

Positive closure for Intesa Sanpaolo, even if it has lost ground compared to the blaze recorded immediately after the release of the accounts. CEO Carlo Messina said, during the call with analysts, that the bank has “clearly excess capital to be distributed to shareholders“, reiterating that “the additional distribution for 2023 which will be quantified upon approval of the year-end results and any further distributions for 2024 and 2025 will be evaluated from year to year”.

L’Euro / US Dollar the session continues on the rise and advances to 1.074. Slight increase ingold, which rises to $1,992.50 per ounce. The Petrolium (Light Sweet Crude Oil) fell by 1.33%, dropping to $81.37 per barrel.

The Spreads improves, reaching +178 basis points, with a decrease of 6 basis points compared to the previous value, with the yield of the ten-year BTP equal to 4.42%.

Among the Euroland indices small step forward for Frankfurtwhich shows an advance of 0.30%, small loss for Londonwhich trades at -0.39%, and remains close to parity Paris (-0.19%).

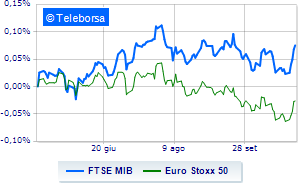

Business Square archive the day with a profit on FTSE MIB by 0.69%, continuing the positive streak that began last Monday; along the same lines, positive performance for the FTSE Italia All-Share, which ends the day up 0.78% compared to yesterday’s close. Excellent performance FTSE Italia Mid Cap (+1.62%); on the same trend, with a clear improvement FTSE Italia Star (+1.95%).

From the closing data of the Italian Stock Exchange, it appears that the exchange value in the session of 3/11/2023 it was equal to 2.57 billion euros, down by 13.09%, compared to 2.95 billion on the day before; while the volumes traded went from 0.71 billion shares in the previous session to 0.76 billion.

Between best performers of Milan, highlighted Nexi (+6.10%, after rumors that Silverlake is also studying the dossiers, after rumors of the interest of CVC, Blackstone and Brookfield), Fineco (+3.52%), Interpump (+2.09%) e DiaSorin (+2.06%, which confirmed the guidance for the whole of 2023 after declining 9-month accounts).

The strongest sales, however, hit ENI, which ended trading at -2.15%. He hesitates Record yourself, which lost 0.79%. Basically weak Saipem, which recorded a decline of 0.77%. It moves below parity Herahighlighting a decrease of 0.65%.

Among the protagonists of the FTSE MidCap, De’ Longhi (+6.74%), MFE A (+5.73%), Seco (+5.54%) e Illimity Bank (+5.37%).

The worst performances, however, were recorded on Saras, which closed at -2.15%. Moderate contraction for Banca Popolare di Sondrio, which suffers a drop of 0.75%. Undertone Mondadori which shows a reduction of 0.71%. Disappointing De Nora Industrieswhich lies just below the levels of the day before.