The French distributor Casino announced, this Monday, September 18, that it had reached an agreement in principle with a new group of creditors who were not affected by the first agreement announced in July relating to the restructuring of its colossal debt, which amounted to 6.4 billion euros at the end of 2022.

In its press release, the group also announced that it had requested the Paris commercial court to extend the conciliation period relating to the restructuring of its debt until October 25. This period of conciliation opened on June 2.

The creditors affected by this new agreement in principle represent the majority of bondholders of Quatrim, an entity which owns Casino’s real estate.

Reimbursement of creditors

The agreement provides that 100% of the proceeds from the disposals of assets held by Quatrim and its subsidiaries, as well as part of the proceeds from the disposals of GreenYellow and other assets of the group, will be allocated to the repayment of these creditors.

In total, proceeds from disposals and cumulative guarantees, 946 million euros are planned to reimburse these holders of secured debt, the principal amount of which amounts to 553 million euros.

The maturity of these bonds, that is to say the deadline for repaying them, is also extended until January 15, 2027, compared to 2024 previously, in order to “implement an asset disposal and reduction plan of Quatrim’s debt”, specifies the group.

Casino adds that “this agreement in principle remains subject to the completion of other restructuring operations announced by the group on July 27, 2023”.

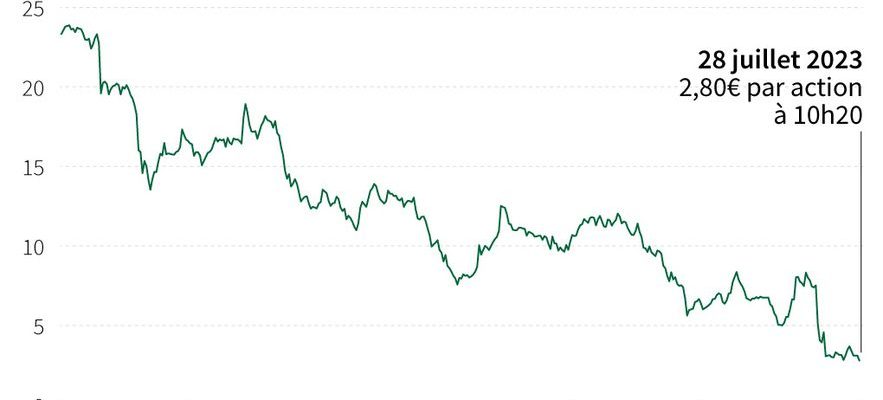

The fall of Casino shares

© / afp.com/Valentin RAKOVSKY, Anibal MAIZ CACERES

Kretinsky on pole

At the end of July, the group’s key creditors undertook “to support and carry out any steps or actions reasonably necessary” for the completion of the restructuring of Casino, and thus to accept the takeover offer from the Czech Daniel Kretinsky and his allies, billionaire Marc Ladreit de Lacharrière and the British fund Attestor.

This offer notably provides for the provision of 1.2 billion euros of new money as well as the reduction of nearly 5 billion euros of the group’s debt. It is also planned to sell Casino activities in Latin America – particularly in Brazil – for which three quarters of the group’s employees work.