(Finance) – Wall Street erased early losses and is moving higher despite a stronger-than-expected monthly jobs report, which has fueled fears that the Federal Reserve could keep interest rates higher for a longer period. In particular, the Department of Labor report showed that thenon-agricultural occupation And increased by 336,000 jobs in September, against market expectations for an increase of 170,000 units. Furthermore, the unemployment rate remained at 3.8% and wages increased at a modest pace.

There are few indications quarterlywith Levi Strauss – one of the world’s largest apparel companies – which lowered its full-year forecast after a disappointing quarterly.

Between companies affected by news There are Pioneer Natural Resources (The WSJ reported that ExxonMobil is currently in negotiations to purchase it for around 60 billion dollars), Tesla (which cut the prices of some Model 3 and Model Y versions in the US) and Philips (after the US Food and Drug Administration said its handling of the 2021 sleep apnea device recall was inadequate).

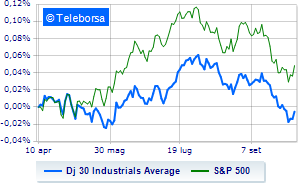

Looking at the main indicesThe Dow Jones, which shows a capital gain of 0.71%; along the same lines, earnings day for theS&P-500, which continues the day at 4,294 points. On the rise Nasdaq 100 (+1.19%); with the same direction, theS&P 100 (+0.79%).

Informatics (+1.52%), telecommunications (+1.18%) e industrial goods (+1.04%) in good light on the S&P 500 list. At the bottom of the ranking, significant declines appear in the sector office consumableswhich reports a decline of -1.34%.

To the top between giants of Wall Street, Salesforce (+2.50%), Caterpillar (+1.96%), Honeywell International (+1.92%) e Walt Disney (+1.84%).

The worst performances, however, are recorded on Wal-Mart, which gets -3.24%. Heavy Verizon Communications, which marks a decrease of -1.78 percentage points. It moves below parity McDonald’s, highlighting a decrease of 1.26%. Moderate contraction for Walgreens Boots Alliancewhich suffers a decline of 1.13%.

Between protagonists of the Nasdaq 100, PDD Holdings (+8.23%), Atlassian (+5.63%), Trade Desk (+5.61%) e Zscaler (+5.53%).

The worst performances, however, are recorded on Mondelez International, which gets -3.69%. Sales up Costco Wholesale, which recorded a decline of 3.04%. Negative session for DexCom, which shows a loss of 1.89%. Under pressure Monster Beveragewhich suffered a decline of 1.74%.