(Finance) – Brilliant upside for Broadcomwhich rises dramatically, with a gain of 4.64%.

The semiconductor maker ended the third quarter with net profits up to $ 3.07 billion, $ 7.15 per share from $ 1.88 billion ($ 4.20) in the same period a year earlier. On an adjusted basis EPS stood at $ 9.73 versus the consensus $ 9.56. For the current quarter, Broadcom expects revenues of approximately 8.9 billion, higher than the 8.8 billion expected by the consensus.

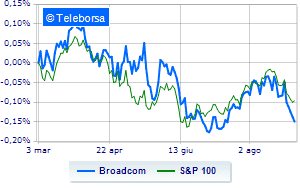

The weekly analysis of the stock with respect toS&P 100 shows a break with respect to the index in terms of relative strength of the US tech companywhich is worse than the target market.

The technical scenario of Broadcom shows a widening of the descending trendline at the test of the USD 505.6 support with a resistance area identified at 521.9 level. The bearish figure suggests the likelihood of testing new identifiable bottoms in the 496.4 area.