(Tiper Stock Exchange) – Shopping in Piazza Affari, which outperformed the cautious day of European stocks. Yesterday the major global central banks confirmed their monetary policy positions at the ECB forum in Portugal. Notably, ECB President Christine Lagarde boosted expectations for a rate hike in July and Fed Chair Jerome Powell explained that there is the possibility of consecutive rate hikes. Powell reiterated this morning that “a strong majority of Federal Open Market Committee (FOMC) participants expect it will be appropriate to raise interest rates two or more times by the end of the year.”

On the macroeconomic front, i consumer prices in Spain in June they increased by 1.9% year on year, below the 2% threshold for the first time since March 2021, the composite index of Eurozone economic confidence fell for the second month to 95.3 points in June from a previous 96.4, a low since November 2022, andinflation in Germany it started to rise again in June, exceeding expectations.

On the FTSEMIB the rises stand out Of Stellantis (after that Renault improved the outlook for the full year 2023 following the success of the new launches), Tenaris (after initiating Buy hedging by Jefferies) And Saipem (after the award of two new contracts worth a total of approximately 1 billion dollars).

Caution prevails overEuro / US Dollar, which continues the session with a slight drop of 0.31%. Basically stable thegold, which continues the session on the previous day’s levels at 1,909.5 dollars an ounce. The Petrolium (Light Sweet Crude Oil) continues the session just below parity with a negative variation of 0.37%.

Slightly up spreadswhich stands at +160 basis points, with a timid increase of 2 basis points, with the yield of the 10-year BTP equal to 4.01%.

Among the European lists Frankfurt is stable, reporting a moderate -0.01%, small loss for Londonwhich trades at -0.38%, and composed Pariswhich grows by a modest +0.36%.

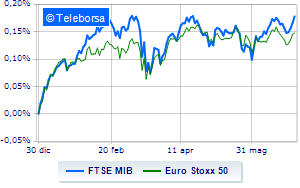

Positive session for Milanese price listwhich closed with a gain of 1.05% on FTSEMIB, consolidating the series of four consecutive hikes, which began last Monday; along the same lines, the FTSE Italia All-Share the day continues with an increase of 0.97%. On equality the FTSE Italia Mid Cap (+0.16%); fractional earnings for the FTSE Italy Star (+0.51%).

At the top of the ranking of the most important titles of Milan, we find Stellantis (+3.56%), BPM desk (+2.76%), Tenaris (+2.69%) and Unicredit (+2.67%).

The strongest sales, on the other hand, show up Nexi, which ended trading at -1.16%. He hesitates Hera, which drops 0.88%. Basically weak ERG, which recorded a decrease of 0.84%. Closes below parity Telecom Italyshowing a decrease of 0.73%.

At the top of the mid-cap rankings from Milan, Bff Bank (+2.66%), Mondadori (+2.47%), Piaggio (+2.26%) and Juventus (+1.86%).

The strongest sales, on the other hand, show up MARR, which ends trading at -2.23%. The negative performance of GV extension, which drops by 1.62%. Moderate contraction for IREN, which suffers a drop of 1.40%. Undertone Tinexta showing a filing of 1.38%.