(Finance) – The European markets ended the session with good increasesthanks above all to a sprint at the end of the day. Piazza Affari is the best among the lists of the Old Continent, driven by energy stocks (benefiting from rising oil prices), industrial and automotive. Supporting crude oil are the decline in US inventories, the boom in exports (5 million barrels a day, an all-time high) and fears that EU sanctions on Russian crude shipped by sea will further increase supply problems.

In the first part of the session the trend was more uncertain, also thanks to aeurozone inflation confirmed at very high levels for the month of July 2022: consumer prices mark + 8.9% on a trend basis, as estimated in the flash estimate and indicated by the consensus (the highest ever recorded since the creation of the euro in 1999) . Isabel Schnabelone of the ECB’s “hawks”, said that prices could rise again in the short termwith the inflation outlook that has not changed since the July interest rate hike.

On the front of central banksthat Norwegian he raised the benchmark interest rate by 50 basis points, as expected, and said he will likely increase it again in September as inflation has risen above forecasts. The central bank Turkish has reduced the official rate from 14% to 13%, despite inflation rising to almost 80%. There Bank of England announced that auctions will begin in September to sell the corporate bonds of the CBPS scheme.

Caution prevails onEuro / US dollar, which continues the session with a slight decrease of 0.56%. L’Gold it is essentially stable at $ 1,758.4 an ounce. Strong earnings day for the Petroleum (Light Sweet Crude Oil), up 2.24%.

On parity it spreadwhich remains at +222 basis points, with the yield of Ten-year BTP which is positioned at 3.31%.

Among the European lists moderate earnings for Frankfurtwhich advances by 0.52%, small steps forward for Londonwhich marks a marginal increase of 0.35%, and a moderately positive day for Pariswhich rises by a fractional + 0.45%.

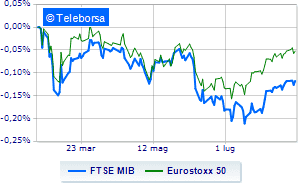

Plus sign closing for Italian price listwith the FTSE MIB up by 1.00%; along the same lines, the FTSE Italia All-Share it gained 0.93% compared to the previous session, closing at 25,125 points. In fractional progress the FTSE Italia Mid Cap (+ 0.39%); with the same direction, just above parity the FTSE Italia Star (+ 0.21%).

At the close of the Milan Stock Exchange, the exchange value in today’s session it was equal to 0.95 billion euro, a marked decrease (-28.86%), compared to the previous session which had seen the negotiation of 1.34 billion euro; while the volumes traded went from 0.42 billion shares of the previous session to today’s 0.3 billion.

Top of the ranking of the most important titles of Milan, we find Tenaris (+ 4.23%), STMicroelectronics (+ 3.24%), Interpump (+ 2.84%) e ENI (+ 2.07%).

The strongest declines, on the other hand, occurred on Leonardowhich closed the session at -1.05%.

Undertone Saipem which shows a filing of 0.78%.

Disappointing Telecom Italiawhich lies just below the levels of the eve.

Lazy Unipolwhich shows a small decrease of 0.67%.

Top of the ranking of mid-cap stocks from Milan, Saras (+ 6.98%), Datalogic (+ 5.28%), Caltagirone SpA (+ 3.95%) e Ariston Holding (+ 3.36%).

Stronger sales, on the other hand, fell on Wiitwhich ended trading at -2.82%.

Under pressure IRENwith a sharp decline of 1.69%.

Suffers Webuildwhich shows a loss of 1.57%.

Prey of the sellers Antares Visionwith a decrease of 1.49%.