(Tiper Stock Exchange) – The first day of the stock market year closed on a positive note for the European markets, which however recorded a day devoid of large peaks and volumes due to the closure of numerous lists around the world (United States, Great Britain, Ireland, Singapore, Japan, Hong Kong and Australia). European equities therefore entered 2023 with a cautious optimismafter a difficult trading year due to rising inflation, aggressive interest rate hikes and rising geopolitical tensions.

The number one of IMFKristalina Georgieva, warned that the new year will be “tougher than the year we leave behind“, because “the big three economies – the US, the EU and China – are all slowing down at the same time”.

Some relief came today from the data of the manufacturing sector in the euro area, according to the December reading of the S&P Global indexes, which suggests that the worst is over. “The outlook has improved thanks to the signals from restoration of supply chains and to a marked one decrease in inflationary pressuresas well as an easing of fears about the energy crisis in the area, including for government aid”, reads the report.

Seat in fractional decline for theEuro / US Dollar, which leaves, for now, 0.46% in the open. L’Gold it is essentially stable at 1,823.8 dollars an ounce. Strong upside for the petrolium (Light Sweet Crude Oil), which posted a gain of 2.60%.

Downhill it spreadswhich retreats to +210 basis points, with a decrease of 9 basis points, while the 10-year BTP reports a yield of 4.55%.

Among the European lists in light Frankfurtwith a large gain of 1.05%, and soars Paris which marks an important progress of 1.87%.

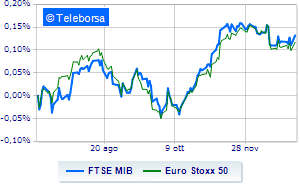

TO Milanclosed the FTSEMIB (+1.9%), which reaches 24,158 points, while, on the contrary, closes the FTSE Italia All-Sharewhich slips to 25,720 points.

Good performance of FTSE Italia Mid Cap (+0.97%); as well as, moderately rising the FTSE Italy Star (+0.38%).

At the close of the Milan Stock Exchange, the exchange value in today’s session it appears to have been equal to 0.87 billion euros, a decided decrease (-18.11%) compared to the previous session which had seen the negotiation of 1.06 billion euros; while the volumes traded went from 0.38 billion shares in the previous session to today’s 0.32 billion.

Among the best Blue Chips of Piazza Affari, fly Saipemwith a marked rise of 5.01%.

Positive trend for Tenariswhich increases by a fair +3.29%.

Well bought Ivecowhich marks a sharp rise of 3.27%.

ENI advances by 3.18%.

The worst performances, however, were recorded on amplifierwhich closed down -2.55%.

Thoughtful DiaSorina fractional decline of 0.65%.

At the top among Italian stocks a mid-cap, Juventus (+4.74%), De’Longhi (+4.29%), Mondadori (+3.21%) and Webuild (+3.05%).

The worst performances, however, were recorded on Brunello Cucinelliwhich closed down -2.75%.

Sales on Alerion Clean Powerwhich records a drop of 1.71%.

He hesitates Mortgages onlinewith a modest drop of 1.06%.

Slow day for Saint Lawrencewhich marks a drop of 0.95%.