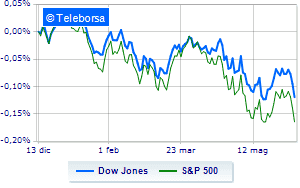

(Finance) – The Wall Street stock market is moving sharply down, in the aftermath of the decisions of the ECB and after the US inflation figure, which has skyrocketed in 40 years, thus fueling the prospect of more aggressive intervention by the Federal Reserve.

Black day for the New York Stock Exchange, which sinks with a drop of 2.25%, continuing the series of three consecutive declines, which began last Wednesday; on the same line, deep red for theS & P-500which falls back to 3,917 points, a sharp decline of 2.52%.

The Nasdaq 100 (-3.15%); with the same direction, the badS&P 100 (-2.68%).

Strong nervousness and generalized losses in the S&P 500 across all sectors, without exclusion. Among the most negative on the S&P 500 list, we find the sectors secondary consumer goods (-4.10%), informatics (-3.27%) e financial (-3.15%).

The only Blue Chip of the Dow Jones is substantially increasing Wal-Mart (+ 0.73%).

The strongest falls, on the other hand, occur on DOWwhich continues the session with -5.36%.

Bad performance for Goldman Sachswhich recorded a decline of 4.92%.

Black session for Boeingwhich leaves a loss of 4.44% on the table.

At a loss JP Morganwhich falls by 4.32%.

Between best performers of the Nasdaq 100, Pinduoduo Inc Spon Each Rep (+ 3.41%), NetEase (+ 3.16%), JD.com (+ 1.12%) e Kraft Heinz (+ 0.56%).

The strongest falls, on the other hand, occur on Docusignwhich continues the session with -24.37%.

Heavy Illuminatewhich marks a drop of -10.06 percentage points.

Negative sitting for Datadogwhich falls by 8.77%.

Sensitive losses for Adobe Systemsdown 7.74%.

Between macroeconomic quantities most important of the US markets:

Friday 10/06/2022

14:30 USA: Consumption prices, yearly (8.3% expected; 8.3% before)

14:30 USA: Consumption prices, monthly (expected 0.7%; previous 0.3%)

4:00 pm USA: University of Michigan Consumer Trust (expected 58 points; preceding 58.4 points)

Tuesday 14/06/2022

14:30 USA: Production prices, monthly (previous 0.5%)

14:30 USA: Production prices, annual (previous 11%).