That the number of frauds has increased in recent years is nothing new. In 2023, the number of reported frauds rose by 22 percent compared to the year before, to 238,000 reports.

During the same period, the estimated profits earned by the fraudsters also increased to a breathtaking SEK 7.5 billion.

Not infrequently, there are reports of increasingly elaborate approaches to get hold of private individuals’ money and assets.

This has resulted in companies, authorities and banks constantly trying to inform and warn of both new and old forms of fraud.

READ MORE: BankID’s change – to stop fraud

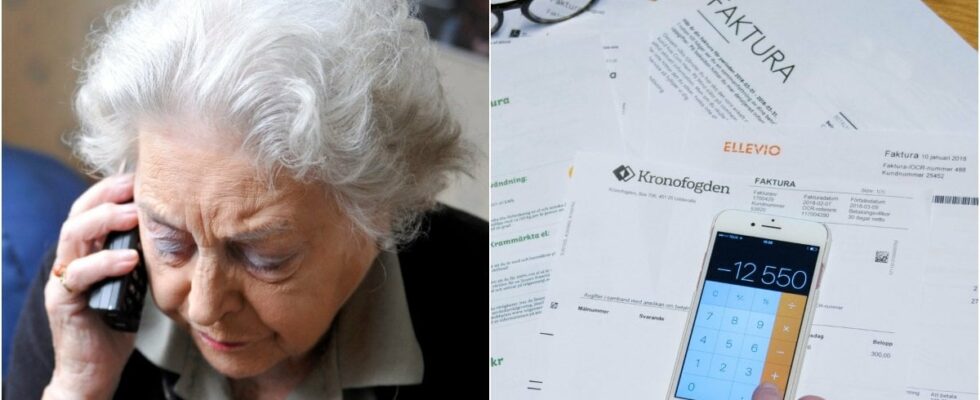

Photo: Caisa Rasmussen / TT The police’s warning about the new form of fraud

Last in line to warn the public is the Police Authority. On their website, they have now informed about a developed form of advertising fraud.

By looking up sellers on buy and sell sites, they ‘buy’ items, ask to have it shipped via PO boxes followed by the scammer sending a shipping link to the seller.

The link is actually a scam page, although it looks serious. There, you are asked to provide bank details and log in with BankID, in a lame attempt to access sensitive information and, by extension, money.

READ MORE: Police warn: Watch out for new scam – changing every day

The Swedish Consumer Agency warns: “The fraudster is often knowledgeable”

It is difficult to say what type of fraud you may be exposed to as there are countless forms of them.

However, the Swedish Consumer Agency has spread knowledge about what are known as investment frauds. Such a thing can take the form of you receiving an email or call from an “advisor” who offers a profitable and efficient investment.

It can also be social media marketing to entice people to invest their money in everything from certificates to cryptocurrencies. But in fact it may be a scam where the money is taken and no investment takes place.

“Investment scams often start with you getting a phone call from someone offering a profitable investment. You can also receive an offer via SMS or e-mail. The fraudster is often knowledgeable and inspires confidence. Often there is also a website that looks genuine,” writes the Swedish Consumer Agency on its website and continues:

“Most often, the fraud begins with a small deposit, a couple of thousand. It is then followed by calls to deposit more and more money”.

If you have been contacted in one way or another regarding an investment opportunity, it may be good to be vigilant. In the worst case scenario, you could be about to fall victim to an investment scam.

DO NOT MISS: Reveal the cunning tricks of BankID fraudsters – that’s how you do it

Photo: Patrik Lundin / SvD / TTKonsumentverket about the fraud: Think about this

But then what should you think about?

The Swedish Consumer Agency lists three important points for you who are unsure and worried:

DO NOT MISS: This is where fraudsters find your information