After the unpleasant surprises of 2023 and 2024, the executive takes its precautions. The government announced, Monday, March 3, an “action plan” to improve the management of public finances, in particular the creation of an “alert committee” which will associate parliament to avoid a new slip of the public deficit. “It’s a real turning point […] In the management of our public finances, which will be in transparency and dialogue, “said the Minister of the Economy, Eric Lombard, during a press conference.

“It is all the more important since we have entered a new period in world history, with the rise of international tensions which are such that the European Union will have to regain increased strategic autonomy”, which will require “budgetary room for maneuver”, he added.

This action plan follows important slippages of the public deficit in 2023 and 2024, allocated in particular to revenue below forecasts, while France is a bad student in the euro zone because of the high deterioration of its public finances. The latter earned him a warning from the S&P rating agency on Friday, which lowered to “negative” the perspective accompanying the note of its debt, while a commission of inquiry of the National Assembly tries to clarify the reasons for these drifts. To hold the objective of a deficit at 5.4 % of GDP for 2025, after about 6 % last year, the government wishes to strengthen dialogue with Parliament on monitoring the execution of the budget.

Meeting three times a year

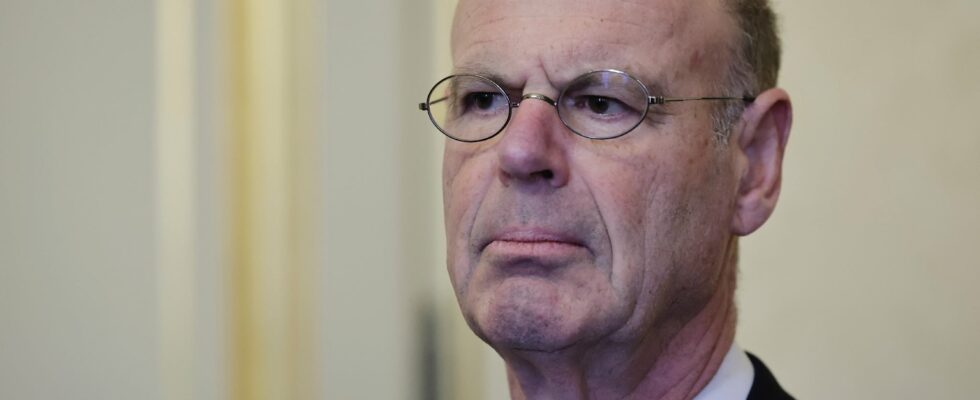

It is a question of extending the consultations of the political groups of the Parliament which had been carried out as part of the difficult development of the 2025 budget after the censorship of the Barnier government in December. Thus, a “alert committee” will bring together, around the ministers of Bercy, the rapporteurs, in particular parliamentarians of the finance and social affairs commissions, representatives of Social Security and the first president of the Court of Auditors, Pierre Moscovici. This structure, which will meet three times a year, will focus on the accounts of the State, Social Security and State operators. “The risk of gap in forecasts for public spending and revenue” will be presented there and “possible corrective measures envisaged”. Pierre Moscovici, who also chairs the High Council for Public Finance (HCFP) often deeming too “optimistic” government forecasts, was not followed on his idea of entrusting the latter to an “independent institution”.

The second axis of the plan provides for a strengthened “transparency”, with a systematic seizure of the High Council for Public Finance and the creation of a “circle of forecasters” which will examine the relevance of macroeconomic forecast hypotheses. A “methodological work” is also announced to explain how Bercy calculates the “trend evolution” of public accounts. The budgetary effort of around 50 billion euros planned in 2025 is indeed calculated on the basis of an estimate of the future evolution of “unchanged political” accounts, and not from the budget of the previous year, as the HCFP is more relevant. These different approaches give rise to different costuses and a diverse appreciation of the nature of the effort made, between expenses and revenues.

A “conversation” with the French

A “conversation” with the French, called “our nation, our finances” is also planned, whose terms remain to be specified. “We want to open the Bercy black box for […] Conforming the conditions of the political compromise, “said Minister Amélie de Montchalin, in charge of public accounts.” Today, our fellow citizens see public finances as an incomprehensible subject, the Minister said in an interview with an interview with La Tribune on Sunday. They have the feeling that budgets are preparing in their backs, that difficult decisions are made without them, but that they are the ones who pay “. In the end of” a peaceful debate “, it considered it necessary to” put the French in the budget cockpit “.

A final component will consist of “improving” forecasting tools and methods concerning the predictability of companies and local authorities spending, poorly estimated over the past two years. Request for reimbursement of VAT credits by companies will be the subject of an audit.