(Finance) – The Board of Directors of Banco BPMresolved to submit to the next Shareholders’ Meeting of 7 April 2022 the request for authorization to purchase and dispose of own sharesin order to implement, in compliance with current legislation, the remuneration policy adopted by the Bank, which provides, in particular, that, for the most important personnel of the Group,

at least 50% of the recognized incentive is paid in shares.

In any case, the purchase and disposal operations will be carried out in compliance with the applicable legislation, in particular in the field of “market abuse”, and ensuring equal treatment of shareholders.

The authorization requested concerns the purchase of treasury shares, for a maximum number of Banco BPM ordinary shares corresponding to an amount not exceeding € 10 million and is required until the Shareholders’ Meeting, which will be subject to the approval of the financial statements. relating to the financial year 2022. The authorization to dispose of treasury shares, even before the purchases have been completed, is requested without time limits.

The purchase price of each of the treasury shares must be at least, not lower than 15% and, as a maximum, not higher than 15% than the official price recorded by the share on the Mercato Telematico Azionario the day before the purchase.

As regards the disposal of the purchased shares, to be carried out in any case in compliance with the applicable regulatory provisions, only the minimum price limit for the sale to third parties is defined, which must in any case be no less than 95% of the average of the official prices recorded by the share on the MTA in the three days prior to the sale. This price limit may be waived in the event of the assignment of treasury shares as part of the implementation of the remuneration policy adopted by the Bank and, in any case, of the assignment of shares (or options under the same) in execution of compensation plans based on financial instruments.

in particular, the purchases must be made through a public purchase offer or exchange offer, or on the market, according to operating methods that do not allow the direct combination of purchase negotiation proposals with predetermined sales negotiation proposals, or through the additional methods permitted by the legislation in force from time to time, taking into account the need to respect the principle of equal treatment of shareholders.

As of 1 March 2022, Banco BPM holds 8,152,151 treasury shares in its portfolio.

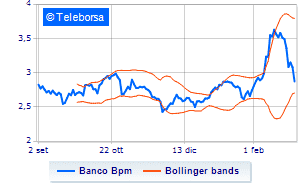

In Piazza Affari, today, discount for Banco BPM which flexes in a decomposed way, archiving the session with a loss of 6.72%.