(Finance) – The Banca Popolare di Sondrio announced that it will propose to the ordinary Shareholders’ Meeting of 30 April 2022, theauthorization for the purchase and sale of own shares pursuant to art. 8 of the Articles of Association and the authorization to use the treasury shares already in charge to service the Remuneration Plan in implementation of the Remuneration Policies

Following the expiry of the previous authorization, the Administration proposes to the Shareholders’ Meeting to grant the Board of Directors a new authorization to purchase and / or dispose of ordinary treasury shares and / or cancel them, in accordance with the current provisions of law and the Articles of Association for the period of time between the date of today’s Shareholders ‘Meeting and the date of the Shareholders’ Meeting called to approve the financial statements for the financial year 2022, it being understood that the start of the purchase program, or its suspension and / or termination is approved by the Board of Directors, with the power to delegate to the Executive Committee, which consequently proceed to make the information requested in correspondence with the start of the program;

Purchase of own shares

– the purchase can be made within a maximum amount of available reserves equal to euro 30,000,000 (thirty million), it being understood that in any case the number of shares in the portfolio must not exceed 2% of the shares making up the share capital;

– the purchase operations can be carried out at any time up to the date of the Shareholders’ Meeting called to approve the financial statements for the financial year 2022;

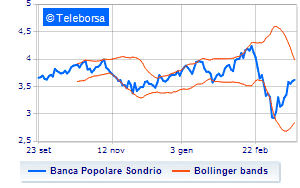

– the purchase price of the shares may not be more than 20% higher than the official price of the Banca Popolare di Sondrio shares recorded by Borsa Italiana in the stock exchange session preceding each individual transaction;

Trading and selling of own shares

– the shares that will be purchased in execution of this Shareholders ‘Meeting resolution, as well as those purchased in execution of previous Shareholders’ resolutions, may be the subject of deeds of sale and disposal and, therefore, be sold even before having exhausted the quantity of purchases covered by the this request for authorization, on one or more occasions, in the manner deemed most appropriate in light of the reasons expressed in the Report of the Board of Directors and in the interest of the Company;

– the sale or disposal operations may be carried out at any time up to the Shareholders’ Meeting called to approve the financial statements for the year 2022;

– the operations of alienation of the own shares purchased can be carried out, in one or more times, even before having exhausted the maximum quantity of own shares that can be purchased and can be carried out in the ways and at the times deemed most appropriate in the interest of the Company, with the adoption of any method deemed appropriate in relation to the purposes to be pursued, without prejudice in any case to compliance with the authorization conditions and the applicable legislation;

– the sale price of the shares – where sales transactions are carried out on the market – cannot be lower by at least more than 20% compared to the official price of Banca Popolare di Sondrio shares recorded by Borsa Italiana in the trading session preceding each individual operation.

Cancellation of own shares

– the shares that will be purchased in execution of this Shareholders ‘Meeting resolution, as well as those purchased in execution of previous Shareholders’ resolutions, may be canceled, in one or more times, in the ways deemed most appropriate in light of the reasons expressed in the Report of the Board of Directors and in the interest of the Company, without prejudice to compliance with regulatory and statutory provisions, with use of the reserve for own shares to cover any differences between the cancellation value and the purchase price.

Furthermore, the Administration proposes to the Shareholders’ Meeting to authorize the Board of Directors to use Banca Popolare di Sondrio ordinary shares already held by the bank for the purpose of the 2022 Compensation Plan based on financial instruments and within the limits of its duration. maximum total value of € 490,000. The number of shares to be used in the service of the aforementioned Plan will be

defined on the basis of the closing price at the date of the Board of Directors which will resolve the assignment of the variable portion of the remuneration.

Meanwhile, on the Milanese price list, the Lombard bank it widens the profit margin compared to the previous day and stands at 3.72 euros.