(Tiper Stock Exchange) – Most Asian stock markets are trading lower today, after the release of “hawkish” minutes by the US Federal Reserve (which open to a greater tightening of monetary policy), weak macroeconomic data in Japan and the continuing uncertainties coming from the Chinese real estate sector.

The rating agency Fitch reported a potential downgrade risk for China’s sovereign rating. The agency told Bloomberg that any extension of government debt could trigger a reconsideration of China’s A+ rating, although it does not expect such a scenario to occur.

Furthermore, i fears of a debt meltdown in China’s real estate sector weighed on sentiment, especially as Country Garden – China’s biggest developer – warned that there are “great uncertainties” about its bond payments.

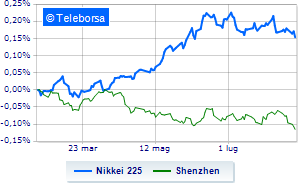

Weak session for the list of Tokyowhich closes with a drop of 0.44% on Nikkei 225 (after data showed the country posted an unexpected trade deficit in July), while, conversely, it hovers around parity Shenzhen, which continues the day at 0.19%. Little move Shanghai.

In red Hong Kong (-1%); in the same direction, slightly down Seoul (-0.54%). In fractional decline mumbai (-0.45%); on the same trend, downhill Sydney (-0.7%).

Substantial invariance for theEuro against the Japanese currency, which changes hands with a negligible +0.01%. Seat substantially unchanged for theEuro against the Chinese currency, which trades with a moderate +0.18%. The session for theEuro against the Hong Kong dollarwhich trades on the previous day’s values.

The yield for theJapanese 10-year bond is equal to 0.65%, while the yield of Chinese 10-year government bond treats 2.57%.

Between macroeconomic quantities most important of the Asian markets:

Thursday 08/17/2023

01:50 Japan: Trade balance (expected ¥24.6Bn; previous ¥43.1Bn)

01:50 Japan: Core Machinery Orders, Monthly (Exp. 3.6%; Previous -7.6%)

06:30 Japan: Services index, monthly (exp. -0.2%; previous 1.2%)

Friday 08/18/2023

01:30 Japan: Consumption prices, annual (expected 2.5%; previous 3.3%).