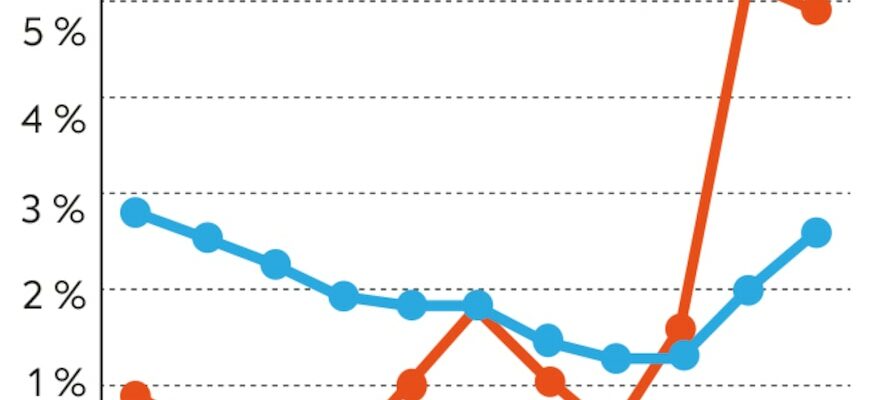

While The rate of the booklet A fell to 2.4 % on February 1, the 2024 remuneration of euros in euros was eagerly awaited. At this stage, insurers are there, with stable remuneration. It was mutual amplifier that opened the ball with a generous 3.75 %. But competition was quick to wake up. Among the most profitable supports, there is no surprise that of Garance, at 3.5 %, which allows it to display a performance of 23.58 % over seven years.

But the actor who currently dominates the ranking is undoubtedly the newcomer to the life insurance market, Corum Savings. Known for its real estate funds and bond management, the company launched a life insurance contract without management fees in 2020, and a fund in euros in 2023. This brought 4.65 % to its holders. Unlike the two mutuals, however, it is only accessible for 25 % of the sums invested in the contract. Also note the good performance of mutualist France, which serves 3.60 % for its members, as well as those of the Carac and MIF, at 3.50 % and 3.35 % respectively on their multi -support contracts, or even MACSF, at 3.10 %.

3840 Infog Patrimoine

© / L’Express

Reserves requested

Bancassurers are not to be outdone. After a real comeback Over the past two years, their funds in euros are maintained at high levels. Société Générale Assurances and Crédit Agricole Assurances have chosen stability with rates unchanged from last year. For example, the Séquoia contract pays between 2.75 and 3.63 % depending on the proportion of units of account held. Predissime 9 displays a rate between 2.40 and 3.20 %. BNP Paribas Cardif is, however, in slight decline with an average rate of 2.90 %, all envelopes combined, most of its contracts offering more than 2.75 % excluding bonus. Among traditional insurers, AXA France displays stable rates compared to 2024, when Allianz wins by 0.5 points.

To reach these levels, the companies were able to count on the good performance of the markets and a strong collection invested in well -paid bonds. Some of them also used their reserves. “The latter belong to the insured and allow us to improve the rate of the fund in euros, which is a liner, while its natural yield finds the level of the market,” explains Olivier Sentis, Managing Director of MIF. It is now done for many contracts.