Sung by Marilyn Monroe as by Rihanna, coveted by Audrey Hepburn in the film Breakfast at Tiffany’s, Brilliant in the windows in Place Vendôme, the diamond has erected as a timeless symbol of beauty and rarity. Yet the sector is going through a difficult pass today. Latest example, the difficulties of the world number one in Beers, to the point that its main shareholder, the Anglo American Mining producer, plans to part with it. With a production of raw diamonds falling 22 % in 2024, the splendid days of this company founded in 1888 now seem distant.

The whole of the value chain is jostled: Botswana has seen its exports of raw diamonds, of which its economy is very dependent, drop by 46 % between 2022 and 2024, according to Rapporte, a specialized analysis company. In India, factories of the city of Surat – hub for the transformation of the precious stone – had to close, for lack of request. In total, last year, the country exported half less polished diamonds than in 2022.

Loss of speed

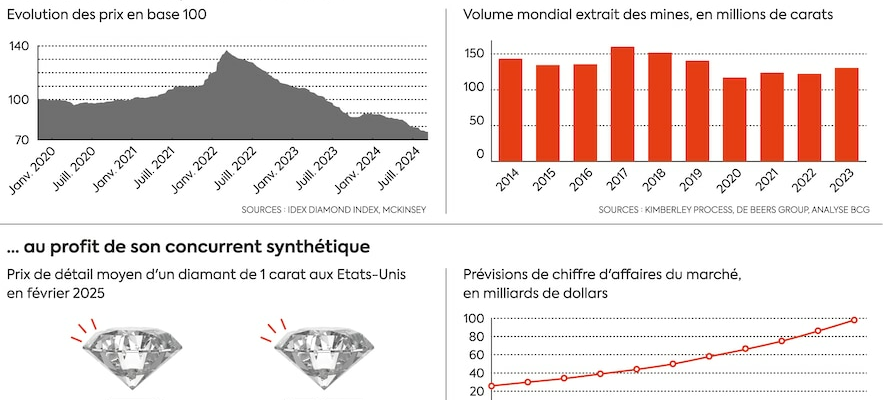

The causes of this degradation are multiple. After a transitional rebound, the economic slowdown of China, a traditionally promising market, has contributed to the collapse of prices since the end of the health crisis – the phenomenon also affects the entire luxury sector. A loss of attraction that benefited gold. “The drop in prices has shaken consumer confidence in diamonds as an investment. This has greatly reduced the demand for natural diamonds and pushed the Chinese to precious metal, which they consider as a stronger placement,” observes Joshua Freedman, a senior repair analyst.

The offer, on the other hand, remained abundant. To prevent prices from collapsing more, from Beers has made stocks, which have reached their highest level since 2008, according to Financial Times.

In the imagination of the general public, precious stone also loses its brilliance. Diamonds are no longer the “best friends of girls” … “There has been a change in the sociology of demand: they make women dream much less, especially young people, than before,” observes Alessandro Giraudo, professor of geopolitics of raw materials at INSEEC. In the United States, its first market, the diamond industry must deal with new practices among consumers aged 25 to 35. “The engagement rings, the main segment of the market, are increasingly bought by couples, instead of being chosen by the future spouse before marriage request, explains Edahn Golan, independent analyst of the diamond industry and director in Tenoris, an analysis company in jewelry. This reduces the pressure to spend more, especially as this clientele tends to prefer synthetic diamonds”.

85 % cheaper

Laboratory products, while their natural equivalent forms for thousands of years in the basements, these substitutes are a real pebble in the shoe of industrialists of the natural diamond. They first seduce with their attractive selling price, around 85 % cheaper than the diamond extract from mines, according to Edahn Golan. So much so that the synthetic diamonds are setting almost half of the engagement rings sold in the United States. Globally, their market share was brushed by 20% in 2024, according to McKinsey. Traditional actors are not about to return to this lost terrain, judges Yoram Finkelstein, head of Gemconcepts, a diamond size company based in Israel. “The natural diamond manufacturers did not understand that the realities of the market had changed. Instead of engaging in a war against laboratory diamonds, they would better bet on it,” he recommends.

With identical aesthetics and physical properties, the synthetic diamond in principle has nothing to envy its counterpart of terrestrial depths. But at the Natural Diamond Council (NDC), we refuse to put them on an equal footing. “It is impossible to compare a natural precious stone produced by the Mother land there are 1 to 3.5 billion years ago and a mass industrial product, mainly from China and India,” offends Mina El Hadraoui, France director of NDC.

And yet, among the jewelers, the followers are more and more numerous. For good reason, the gross margin is around 70 % for laboratory products, twice as much as for diamonds from mine, calculates Edahn Golan. The Danish giant Pandora began to use the first in 2021, ceasing at the same time to use the latter. “Our goal is to make diamond jewelry accessible to a wider audience and for more opportunities,” argues a spokesperson for the group. The brand also praises the carbon footprint of its synthetic rivals, 95 % lower. A size asset in the eyes of certain young consumers.

To counter this competition, the diamonds are mobilizing. As with this verification machine to distinguish the two types of stones, unveiled by De Beers, which will be available in stores. In parallel, marketing campaigns are multiplying, emphasizing a “natural treasure”, dating from several millennia, faced with a laboratory stone described as artificial. The quarrel extends to semantics. In France, a decree decided: impossible to use the “laboratory diamond” for a product at least partially manufactured by humans. Only “synthetic” or “synthetic” appellations are authorized.

The diamond market loses its brilliance in favor of synthetic stones.

© / Manon Guibon / L’Express

This may seem anecdotal, but Alix Gicquel has undergone the consequences. This university professor founded in 2016 the start-up Diam Concept, a French producer of synthetic diamonds. Beyond rings and necklaces, these gems also find applications in quantum or semiconductors. “The natural diamond has different characteristics from one stone to another. However for industrial applications, the quality of the diamond must be reproducible,” she explains. The adventure turned short. Partly because of a denomination deemed devaluing by the researcher: “with the name” synthetic “, which reminds more of a cheap product than with jewelry, it was very difficult to attract consumers who associated these diamonds with” false “, such as synthetic fur. How to bring out a business with such a name?”, She regrets.

Russian Alrosa sanctioned

A small victory for the natural diamond sector, whose challenges remain significant. Geopolitics, in particular, invites itself into the equation. Russia, the world’s leading producer of diamonds in volume, has seen its national Alrosa giant targeted by war -related sanctions in Ukraine. According to Reuters, the company could accuse a drop in production this year. “The sanctions against Russia have not had a strong impact on diamond prices so far, given the excessive stocks of the last two years. But as they will normalize, the production declining, the sanctions will probably weigh more on the market,” anticipates Paul Zimnisky, independent consultant based in the United States.

The prices would be more advanced in parallel, the extraction is increasingly expensive. “Mine operating costs have increased and productivity has not improved in recent years, which increases the overall bill for natural diamonds,” notes Sebastian Reiter at McKinsey. The gap with the summary version therefore may widen. Paul Zimnisky remains optimistic: “Diamonds have long been one of the most popular luxury products, recalls the consultant. I don’t think that will change”. “The diamond is eternal”, proclaimed the historic slogan of De Beers. The myth remains to be verified.

.