(Finance) – With reference to the buy-back program approved by the Shareholders’ Meeting on 20 October 2021, Aquafil has communicated that it has purchasedbetween 22 and 25 March 2022 inclusive, overall 38,309 treasury shares at the average unit price of € 6.6784 for a countervalue overall of 255,842.92 euros.

Following what has already been communicated to the market, the purchases, for a maximum amount held in the portfolio by the Company and by its subsidiaries that does not exceed a total of 3% of the share capital, have the purpose of allowing Aquafil to purchase and / or to dispose of the Company’s ordinary shares to carry out any investment transactions, as well as to contain anomalous movements in prices and favor the regular conduct of trading outside the normal variations linked to market trends, and for storage for subsequent uses ( establishment of the so-called “securities warehouse”), in line with the strategic guidelines that the Company intends to pursue: consideration for extraordinary transactions or other provision and / or use to service extraordinary transactions with other parties.

Following the purchases announced on March 28, Aquafil holds 495,399 treasury shares, equal to 0.9672% of the share capital.

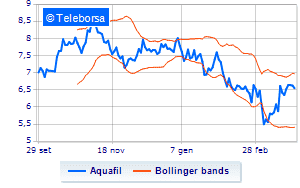

Meanwhile, on the Milanese price list, Aquafil widens the profit margin compared to the values of the eve, and stands at 6.72 euros.