(Finance) – The performance of Analog Deviceswith a percentage change of 1.01%.

The semiconductor maker announced a better-than-expected quarterly report: second-quarter earnings hit $ 2.4 per share versus analysts’ estimated $ 2.11. Revenues reached $ 2.97 billion, which compares with the $ 2.83 billion indicated by the consensus. For the third quarter of fiscal year 2022, the company expects revenue of $ 3.05 billion and EPS of $ 1.55.

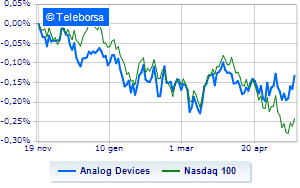

Over the course of this year, Analog Devices shares are down 6%, outperforming the S&P 500, which is still down 14% until the time of writing.

At a comparative level on a weekly basis, the trend of company active in the production of semiconductors shows a more marked trend than the trendline of Nasdaq 100. This demonstrates the greater propensity to buy by investors towards Analog Devices with respect to the index.

The technical status of the microchip manufacturer it is strengthening in the short term, with area of resistance seen at USD 167.1, while the first support is estimated at 162.8. The technical implications lean towards a broadening of the performance in an upward direction, with resistance seen at 171.3.