(Finance) – Positive session on Wall Street, after the publication of the last salient macroeconomic data before the Christmas holidays. Before the market opened, Bureau of Economic Analysis announced that the core personal consumption expenditures price index – the Fed’s preferred inflation parameter – fell to +3.2% on an annual basis in November (+3.4% the previous month and +3.3% expected).

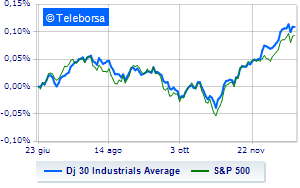

This reinforces expectations that inflation is now well on a downward path and the Investor forecasts for interest rate cuts of around 150 basis points next year. These estimates, and the Federal Reserve’s more dovish tone at its last meeting, have been behind most of the recent gains in U.S. stock indexes.

Between stories of the day there is Nikeafter the sportswear maker said it was targeting cost savings of up to $2 billion in a picture of weaker sales. “We are seeing signs of more cautious consumer behavior around the world,” CFO Matthew Friend said during the call with the financial community.

On the front ofBUT, Bristol Myers Squibbone of the world’s leading pharmaceutical companies, has entered into a definitive merger agreement under which it will acquire Karuna Therapeutic for 330 dollars per share (53% premium compared to the last closing) in cash, for a total equity value of 14 billion dollars.

As regards the new prices, Lionsgate announced today that its Business Studios will list on the Nasdaq via a business combination with SPAC Screaming Eagle Acquisition Corp in a transaction valuing Lionsgate Studios at approximately $4.6 billion.

Looking at the main indicesthe US stock market shows a timid gain, with the Dow Jones which is achieving +0.22%; along the same lines, theS&P-500 advances fractionally, reaching 4,767 points. Just above parity the Nasdaq 100 (+0.35%); on the same trend, fractional gains for theS&P 100 (+0.36%).