(Finance) – The headline is the protagonist on Wall Street American Express which shows an excellent performance, with an increase of 9.58%.

The convincing outlook provided by the financial services giant helps to assist the shares. For FY 2023, AmEx expects earnings per share of between $11 and $11.40 versus the consensus $10.55.

The fourth quarter of 2022 closed with revenues up 17% to a record $14.17 billion (consensus $14.22 billion), while net profit fell by 9% to $1.57 billion.

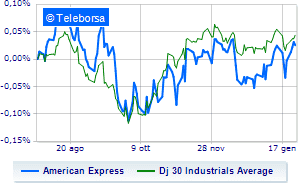

The analysis of the stock performed on a weekly basis highlights the bullish trendline of famous credit card group more pronounced than the trend of Dow Jones. This expresses the market’s greater attractiveness towards the stock.

The short-term technical status of American Express highlights a broadening of the positive performance of the curve with the first resistance area identified at USD 173.7. Risk of a possible correction up to the 166.7 target. Expectations are for an increase in the uptrendline towards the 180.7 resistance area.