(Finance) – Definitely positive session for Amazonwhich is trading up 6.62% after the Seattle giant beat analysts’ expectations for third-quarter revenues and earnings.

In detail, Amazon recorded earnings per share of 94 cents against estimates of 58 cents. Net profit more than tripled to 9.9 billion, from 2.9 billion a year earlier.

Revenues amounted to 143.1 billion dollars against the 141.4 billion consensus estimate. Revenues were slightly below expectations Amazon Web Services equal to 23.1 billion against the 23.2 billion expected by the market, while the advertising it guaranteed 12.1 billion, against the 11.6 billion estimates.

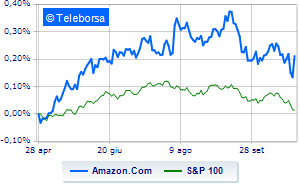

On a weekly basis, the stock’s trend is more solid than that ofS&P 100. At the moment, therefore, the appeal of investors is aimed more decisively at e-commerce giant compared to the reference index.

The general technical context highlights bearish implications that are strengthening for Amazon, with negative stresses such as to force levels towards the support area estimated at 126.1 USD. Contrary to expectations, however, bullish pressures could push prices up to 128.3 where there is an important resistance level. The dominance of the bears fuels negative expectations for the next session with a potential target set at 124.7.