(Finance) – Pressure on Alstomwhich loses ground, showing a decline of 35.55%.

The decision announced by Alstom to reduce its cash flow forecasts, due to an increase in production and delays in some orders, contributed to weighing on the shares of the French train manufacturer.

The Group now expects negative free cash flow for the full year, between 500 and 750 million euros, versus a “significantly positive” result previously expected.

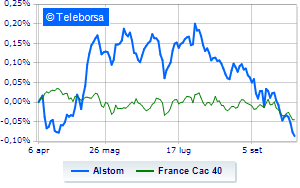

The progress of French industrial group in the week, compared to CAC40detects a lower relative strength of the stock, which could become prey to sellers ready to take advantage of potential weaknesses.

New technical evidence classifies a worsening of the situation for Alstom, with potential descents to the most immediate support area seen at 13.02 Euro. Sudden strengthening would instead undermine the above scenario with a bullish trigger and target on the most immediate resistance identified at 14.82. Expectations for the following session are for a continuation of the decline up to the important support positioned at 12.22.