(Finance) – Purchases widespread on European stock lists, with Piazza Affari closing with the same positive performance of the Old Continent. In the meantime, the US markets are moving into negative territory.S & P-500, which recorded a decrease of 0.23%. Uncertainty remains on the evolution of the Ukrainian crisis and on the risks of a blockage of gas supplies to Europe. “We continue to fear that there will be a new escalation before the conflict comes to an end – commented Mark Dowding, CIO of BlueBay – It seems difficult to imagine that Putin calmly accept defeat and it is possible that the recent withdrawal from Kiev is little more than a tactical reorganization before a new push “.

At Piazza Affari shines Finecowhich Equita has included in the Best Picks selection, go up Campariafter promotions from various analysts, e Saipem, with S&P revising the rating to BB with a positive outlook. Keep climbing Generalon which it could be in place a roundup of actions for the battle for governance in view of the budget meeting at the end of the month.

Sitting in fractional reduction for theEuro / US dollar, which for now leaves 0.23% on the parterre. Weak session forgold, which trades with a drop of 0.45%. The Petroleum (Light Sweet Crude Oil) loses 0.08% and continues to trade at $ 100.4 per barrel.

Jump up it spreadpositioning itself at +154 basis points, with an increase of 4 basis points, with the yield of the ten-year BTP equal to 2.10%.

Among the Euroland indices positive balance for Frankfurtwhich boasts an improvement of 0.22%, substantially tonic Londonwhich records a capital gain of 0.30%, and moderate gain for Pariswhich is up by 0.37%.

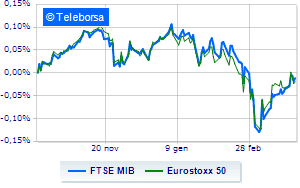

Slight increase for the Milanese stock exchange, with the FTSE MIB which rises by 0.57% to 25,163 points, while, on the contrary, a negative day for the FTSE Italia All-Sharewhich closes the session at 27,297 points, down 1.18%.

Fractional earnings for the FTSE Italia Mid Cap (+ 0.42%); without direction the FTSE Italia Star (+ 0.1%).

On the Milan Stock Exchange, the turnover in today’s session was equal to 2.69 billion euro, remaining unchanged compared to the previous session; the volumes traded went from 1.13 billion shares of the previous session to today’s 1.04 billion.

At the top of the ranking of the most important titles of Milan, we find Fineco (+ 3.36%), Amplifon (+ 3.31%), DiaSorin (+ 2.57%) e Saipem (+ 2.18%).

Stronger sales, on the other hand, fell on Telecom Italiawhich ended trading at -3.45%.

Thud of STMicroelectronicswhich shows a 2.42% drop.

Sales on Interpumpwhich recorded a decline of 1.88%.

Negative sitting for Nexiwhich shows a loss of 1.62%.

Top of the ranking of mid-cap stocks from Milan, Antares Vision (+ 3.77%), Alerion Clean Power (+ 3.31%), IREN (+ 3.00%) e doValue (+ 2.60%).

The worst performances, however, were recorded on Intercoswhich closed at -2.63%.

Letter on GVSwhich records a significant decrease of 2.31%.

Under pressure Piaggiowhich shows a decrease of 2.26%.

It slips Carel Industrieswith a clear disadvantage of 1.72%.

Between the data relevant macroeconomics:

Friday 01/04/2022

00:50 Japan: Tankan Index, quarterly (12 points expected; 17 points preceded)

half past one Japan: Manufacturing PMI (expected 53.2 points; preceding 52.7 points)

02:45 China: Caixin manufacturing PMI (expected 50 points; preceding 50.4 points)

10:00 European Union: Manufacturing PMI (expected 57 points; preceding 58.2 points)

11:00 am European Union: Consumption prices, monthly (previous 0.9%).