(Finance) – Purchases widespread on European stock listswith Piazza Affari closing with the same positive performance of the Old Continent, on the day the Bank of England raised interest rates by half a percentage point, in line with expectations, the largest increase since 1995, to fight inflation which reached 9.4% in June.

Meanwhile, the ECB, in its economic bulletin, spoke of a slowing down in the Eurozone economy and of shadows on the prospects for the second half of the year.

On the currency market, slight growth ofEuro / US dollar, which rises to an altitude of 1.022. L’Gold trading continues at $ 1,787.8 an ounce, an increase of 1.33%. Oil (Light Sweet Crude Oil) collapsed by 3.31%, falling to $ 87.66 per barrel.

It slightly reduces it spreadwhich reaches +209 basis points, with a slight decrease of 4 basis points, while the yield of the 10-year BTP stands at 2.84%.

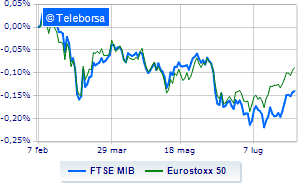

In the European stock market scenario moderately positive day for Frankfurtwhich rises by a fractional + 0.55%, flat London, which holds parity; sitting without momentum for Paris, reflecting a moderate increase of 0.64%. The Milanese price list shows a timid gain in closing, with the FTSE MIB which scored + 0.31%; on the same line, earnings day for the FTSE Italia All-Sharewhich ends the day at 24,722 points.

The exchange value in today’s session it amounted to € 1.76 billion, up from € 1.7 billion on the eve, while volumes stood at € 0.57 billion, compared to the previous € 0.43 billion.

Between best Italian stocks large cap, high DiaSorin (+ 4.34%).

Shopping hands-on Prysmianwhich boasts an increase of 4.24%.

Effervescent Monclerwith an increase of 2.62%.

Glowing Mediolanum Bankwhich boasts an incisive increase of 2.54%.

The strongest declines, on the other hand, occurred on Saipemwhich closed the session at -5.47%.

Letter on Tenariswhich recorded a significant decline of 3.81%.

Goes down Banco BPMwith a decline of 3.26%.

Collapses Telecom Italiawith a decrease of 3.01%.

Top of the ranking of mid-cap stocks from Milan, Safilo (+ 12.65%), Carel Industries (+ 8.88%), De ‘Longhi (+ 4.50%) e doValue (+ 4.30%).

The strongest declines, on the other hand, occurred on Saraswhich closed the session at -10.46%.

Sales hands on Mfe Awhich suffers a decrease of 4.01%.

In red ENAVwhich shows a marked decline of 2.97%.

The negative performance of Salcef Groupwhich falls by 1.60%.

Between the data relevant macroeconomics:

Thursday 04/08/2022

08:00 Germany: Industry orders, monthly (expected -0.8%; previous -0.2%)

13:30 USA: Challenger layoffs (formerly 32.52K units)

14:30 USA: Balance of trade (expected -80.1 B $; previously -84.9 B $)

14:30 USA: Unemployment Claims, Weekly (Expected 259K Units; Previous 254K Units)

Friday 05/08/2022

half past one Japan: Real household expenses, monthly (expected 0.2%; previous -1.9%).