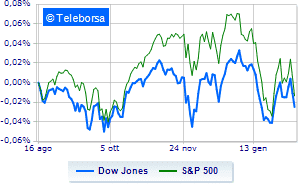

(Finance) – On Wall Street, the Dow Jones it is substantially stable and is positioned on 34,687 points; on the same line, day without infamy and without praise for theS & P-500, which remains at 4,421 points. Salt the Nasdaq 100 (+ 0.76%); along the same line, in fractional progress theS&P 100 (+ 0.26%). After an opening marked by the red color, the American market has improved after the comments by Russian Foreign Minister Lavrov, which eased fears of an impending Russian invasion of Ukraine. However, investors continue to weigh the uncertainty related to moves of the FED; the chairman of the St. Louis Federal Reserve, James Bullardreiterated his call for a faster withdrawal of monetary stimulus, saying the Fed must offer reassurance that it will defend its inflation target of 2%.

Positive result in the S&P 500 basket for sectors secondary consumer goods (+ 1.56%), telecommunications (+ 0.83%) e Informatics (+ 0.57%). In the lower part of the S&P 500 ranking, significant declines are manifested in the sectors power (-2.70%), sanitary (-0.90%) e utilities (-0.79%).

Among the best Blue Chips of the Dow Jones, Walt Disney (+ 2.11%), Nike (+ 2.07%), American Express (+ 1.14%) e Visa (+ 1.03%).

The strongest sales, on the other hand, show up on Walgreens Boots Alliancewhich continues trading at -2.38%.

In red Chevronwhich shows a marked decline of 1.97%.

The negative performance of IBMwhich falls by 1.71%.

Johnson & Johnson drops by 1.35%.

To the top between tech giants of Wall Streetthey position themselves Netflix (+ 3.07%), Tesla Motors (+ 2.91%), Nvidia (+ 2.86%) e Amazon (+ 2.78%).

The strongest falls, on the other hand, occur on Modernwhich continues the session with -12.32%.

Breathless Xilinxwhich falls by 9.99%.

Effervescent Garminwith an increase of 5.25%.

Decline for Regeneron Pharmaceuticalswhich marks a -1.96%.

Between macroeconomic variables most important in the North American markets:

Tuesday 15/02/2022

14:30 USE: Empire State Index (12 points expected; previous -0.7 points)

14:30 USE: Production prices, monthly (expected 0.6%; previous 0.2%)

14:30 USE: Production prices, annual (9.1% expected; previous 9.7%)

Wednesday 16/02/2022

14:30 USE: Export prices, monthly (1.4% expected; previous -1.8%)

14:30 USE: Import prices, monthly (expected 1.3%; previous -0.2%).