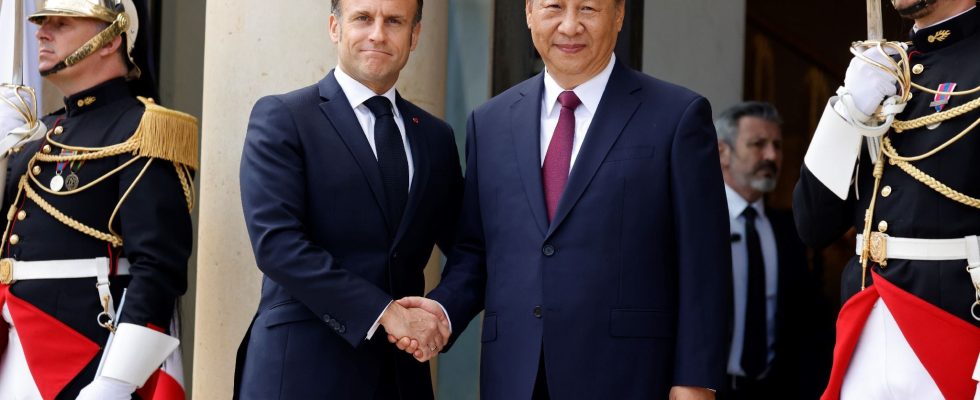

How can we escape Chinese dependence and finally manage to jump on the green technology train on European soil? It will take the pure air of the Pic du Midi to help Emmanuel Macron solve this puzzle. For now, his counterpart Xi Jinping, on a two-day visit to France – maintains the advantage in all areas: costs, amounts invested, manufacturing times, regulations…

“Take the electrolyzer manufacturer McPhy. Its gigafactory located in Belfort will ramp up, producing perhaps 500 or 600 megawatts around 2026 or 2027, warns Julien Moulin, president of Française De l’Energie (FDE), a producer independent of 100% carbon-free energies But in the top 5 Chinese competitors, we already find companies capable of delivering 3 gigawatts of capacity today and in 2026, these players will perhaps be at 10 gigawatts each. Added to this problem of scale is that of regulation because on the European side, there is no barrier to entry. In other words, nothing prevents French companies needing to equip themselves with an electrolyzer to produce hydrogen from purchasing Chinese equipment!

“If we really want to capture the added value in the hydrogen sector, we must favor European players,” explains the entrepreneur, who knows well how competitive Chinese companies can be. For its future green energy production site located in Norway, FDE recently launched a call for tenders. The five most interesting proposals, for the delivery of electrolyzers or compressors, came from China. “The price gap with local producers was not 10% but 70%!” confides Julien Moulin.

Same causes, same effects

How to fight in these conditions? Certainly, FDE has included in its contract a preference clause for local players, a way of encouraging Scandinavian producers. “But in the best case scenario, they have three or four installations to show us. Their Chinese competitors have many more. Their feedback is therefore much more important. An additional advantage. And as in the end, I have no encouragement to buy Norwegian or French, China keeps the advantage, deplores the entrepreneur.

This distortion of competition is already extremely costly for Europe. “In the solar panel sector, the latest mohicans like Systovi are going out of business. However, these are beautiful boxes which have managed to produce on the Old Continent in 2024 despite Chinese competition”, laments Thomas Pellerin Carlin, former director of the energy center of the Jacques-Delors Institute and candidate for the European elections on the list carried by Raphaël Glucksmann. “On wind power, Vestas and Siemens are still resisting. Engie also thanks to the American domestic market. Otherwise, we only find Chinese actors. If we don’t change anything, what happened with solar panels will happen again for electrolysers”, warns Julien Moulin.

“We should put up barriers to entry for China, but since we brought this giant into the WTO in 2000, this is not possible,” says an expert. “The strategy of the John Cockerill group – a producer of electrolysers based in Liège – is interesting. They have taken the majority of a Chinese player and now they are going to build a factory in Mulhouse. This should allow them to benefit from the return of “Chinese experience and to have a lower cost structure because certain components will be manufactured in China. Their factory could therefore resist competition for a while”, estimates Julien Moulin. But for others, it will be more like David against Goliath.

.