(Finance) – Brilliant upside for Affirm Hldgswhich rises dramatically, with a gain of 23.45%.

San Francisco-based fintech, specializing in the emerging buy-now, pay-later (BNPL) segment, closed the third quarter with a net loss of 55 million(19 cents per share) in sharp decline compared to the red of 287 million, (1.23 dollars) recorded in the same period a year earlier. Analysts’ estimates were for a loss of 46 cents per share.

THE revenues they have risen to 355 million from 231 and are higher than the 344 million indicated estimated by the consensus.

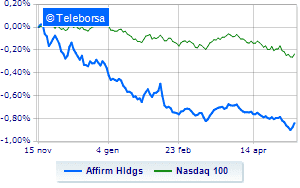

The one-week trend Affirm Hldgs is more sluggish than the trend of Nasdaq 100. Such a breakdown could trigger opportunities for the market to sell the stock.

The technical framework of Affirm Hldgs signals a widening of the negative trend line with a descent to the support seen at USD 20.55, while on the upside it identifies the resistance area at 24.66. Forecasts are for a possible further decline with a target set at 18.82.