The world of structured products has evolved significantly in recent years, in light of the rise in interest rates. Indeed, the latter are the fuel that powers the performance engine of these supports. Based on a formula known from the moment of subscription, they make it possible to obtain a gain linked to the financial markets accompanied by more or less strong protection against their decline.

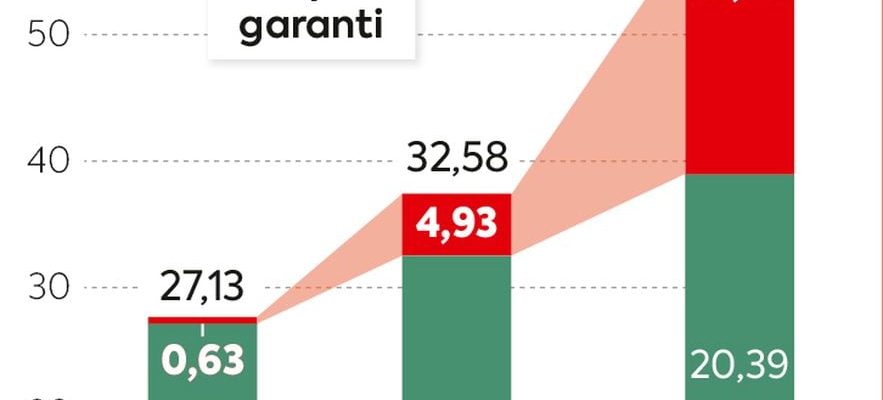

This more supportive environment has allowed the explosion of products with capital guaranteed at maturity: their value varies upwards and downwards throughout their lifespan but the saver who keeps his investment until the end is assured of recover, at a minimum, his stake. Thus, according to Hilbert IS estimates, payments have almost quadrupled on products with guaranteed capital. They represented almost half of structured product sales in 2023.

Savers are fond of this type of product. “The market is very dynamic in France because the appetite for risk is low,” underlines Marc Tempelman, co-founder of Cashbee. Especially as long as you are selective, it is possible to find very attractive supports currently. Thus, Cashbee’s latest creation, called Onyx 4, displays a promise of remuneration of 10.05% per year, once the costs of the life insurance in which it is housed are deducted.

Guaranteed capital products are exploding

© / Art Press

Pay attention to management fees

This is a debt security with a duration of ten years, issued by Société Générale. At the end of the product’s life, if the euro zone banking sector index (Eurostoxx Bank) shows progress or stability compared to the launch date, the coupons are paid. “Stock market valuations are generally high but certain sectors are lagging behind and banking is one of them,” explains Marc Tempelman. The establishments are robust and the rate environment is profitable for them, so we are betting on the markets catching up. ” Otherwise, the holders simply recover their capital. Please note, as the envelope management fees remain due, the initial investment will however be reduced by 10% (i.e. ten years of annual management fees of 1%)!

Where is the wolf? It lies in the fact that the bank can recall the product, at its discretion, each year on the anniversary date. An option that it will exercise if it succeeds in obtaining cheaper financing elsewhere. “There is great uncertainty on this parameter, recognizes Marc Tempelman. Interest rates will probably fall but we do not know how the risk premium paid by a particular establishment will evolve.” A very well-paid hazard.

.