(Tiper Stock Exchange) – Piazza Affari does not budge from the previous values, in line with the main markets of Euroland. Meanwhile, the New York square is positive with theS&P-500which marks an increase of 0.76%.

L’Euro / US Dollar it is substantially stable and stops at 1.051. L’Gold trading continues with a fractional gain of 0.21%. Oil (Light Sweet Crude Oil) shows a timid gain and marks a +0.92%.

Back to climb it spreadssettling at +187 basis points, with an increase of 6 basis points, with the yield on the 10-year BTP equal to 3.68%.

Among the markets of the Old Continent little moved Frankfurtwhich shows +0.02%, substantially unchanged Londonwhich reports a moderate -0.12%, and remains close to parity Paris (-0.2%).

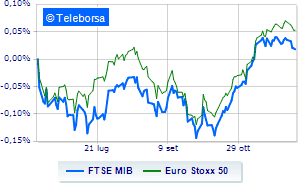

Basically stable Piazza Affari, which closes the session on the levels of the eve with the FTSEMIB which stops at 24,207 points; on the same line, colorless the FTSE Italia All-Sharewhich closes the session at 26,228 points, on the levels of the eve.

Without direction the FTSE Italia Mid Cap (+0.12%); just above parity the FTSE Italy Star (+0.2%).

On the Milan Stock Exchange, the value of trades in today’s session was equal to 1.28 billion euros, down by 302.7 million euros, compared to 1.59 billion on the previous day; volumes stood at 0.3 billion shares, up from 0.41 billion previously.

Of the 396 stocks traded, 142 stocks closed today’s session higher, while 169 closed lower. The remaining 85 titles are unchanged.

Between best performers of Milan, in evidence Moncler (+2.41%), Saipem (+2.08%), STMicroelectronics (+2.02%) and Hera (+1.96%).

The strongest sales, however, fell on Stellantiswhich finished trading at -2.76%.

The negative performance of Italian postwhich drops by 1.80%.

He hesitates Italgaswhich drops 1.15%.

Basically weak Campariwhich recorded a decrease of 1.08%.

At the top among Italian stocks a mid-cap, Carel Industries (+2.99%), Intercos (+2.94%), Juventus (+2.76%) and MARR (+2.30%).

The strongest sales, however, fell on Saraswhich finished trading at -2.51%.

Caltagirone SpA drops by 2.38%.

Decided decline for GV extensionwhich marks a -1.89%.

Under pressure doValuewith a sharp drop of 1.59%.