(Finance) – Sitting down for the main stock exchanges of the Old Continent. On the other hand, the square in Milan, which is positioned on the parity line, in one, holds sitting without great ideas and where investors always find themselves weighing the risks of a monetary tightening, a prolongation of the war in Ukraine and a slowdown in Chinese growth. The fears of high inflationwith i UK consumer prices which jumped to 9% year-on-year in April. “Economists had forecast 9.1%, and this is the first time since October 2021 that the CPI number has been below expectations – commented James Lynch, investment manager of Aegon Asset Management – In June it is almost certain. another move by the BoE to 1.25% after confirming this number and this week’s employment data. “

Little move UniCreditwho does not react to rumors about contacts with Commerzbank for a possible merger, set aside following the outbreak of the war in Ukraine. The analysts of Equity believe that the operation “involves a high execution riskgiven that to be accreative EPS it would have to involve significant cost synergies “and note that” both banks are currently engaged in the management of exposures in Russia, an element that adds further complexity to the transaction “.

L’Euro / US dollar the session continues just below par, with a drop of 0.42%. L’Gold the session continued at the levels of the day before, reporting a variation of + 0.01%. Crude Oil (Light Sweet Crude Oil) continued the session higher and advanced at $ 114.4 per barrel.

On parity it spreadwhich remains at +190 basis points, with the yield on the ten-year BTP standing at 2.94%.

Among the main European stock exchanges nothing done for Frankfurtwhich changes hands on parity, colorless Londonwhich does not register significant changes compared to the previous session, and without momentum Pariswhich trades with a -0.12%.

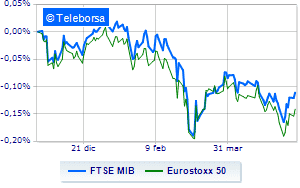

The Milan Stock Exchange stops on parity, with the FTSE MIB which stands at 24,313 points; on the same line, the FTSE Italia All-Sharewith the prices reaching 26,545 points.

Without direction the FTSE Italia Mid Cap (-0.05%); slightly negative on FTSE Italia Star (-0.3%).

Among the best Blue Chips of Piazza Affari, in evidence Prysmianwhich shows a strong increase of 2.65%.

Good performance for Snamwhich grew by 1.48%.

Sustained CNH Industrialwith a decent gain of 1.48%.

Good ideas on Iveco Groupwhich shows a large advantage of 1.45%.

The strongest sales, on the other hand, show up on Mediobancawhich continues trading at -2.64%.

It slips Saipemwith a clear disadvantage of 1.68%.

In red Amplifonwhich shows a marked decline of 1.52%.

The negative performance of Telecom Italiawhich falls by 1.12%.

Top of the ranking of mid-cap stocks from Milan, Seco (+ 2.41%), ERG (+ 2.28%), Salcef Group (+ 1.85%) e Datalogic (+ 1.66%).

The worst performances, on the other hand, are recorded on Antares Visionwhich gets -3.28%.

Autogrill drops by 1.98%.

Decline for Wiitwhich marks a -1.89%.

Under pressure Zignago Glasswith a sharp decline of 1.68%.

Between macroeconomic quantities most important:

Wednesday 18/05/2022

01:50 Japan: GDP, quarterly (expected -0.4%; previous 0.9%)

06:30 Japan: Industrial production, monthly (expected 0.3%; previous 2%)

08:00 United Kingdom: Production prices, monthly (expected 1%; previous 1.9%)

08:00 United Kingdom: Production prices, annual (expected 12.5%; previous 11.9%)

08:00 United Kingdom: Consumption prices, monthly (expected 2.6%; previous 1.1%).