(Finance) – Open Fiber, TIM And FiberCop they signed a commercial agreement that allows the reuse of network infrastructures in the so-called white areas, in which the construction under concession of a TLC infrastructure was financed with public funds. The agreement – officially announced by the three companies with a joint note – inaugurates one new phase of relations between the main Italian infrastructure operatorsie aims at a more efficient use of resources, with a view to accelerating coverage of the country with VHCN networks (Very High Capacity Network).

In the white areas – where Open Fiber was awarded the three public tenders launched by Infratel – the agreement provides that Open Fiber purchases from FiberCop, for a total value of more than 200 million euros, the right of use (IRU) for aerial infrastructures and access links to the customer’s home. At the same time, TIM undertakes to make Open Fiber optic fiber available to its customers in the white areas. This will make it possible to activate at least 500,000 customers on the Open Fiber network who will ask to use FTTH (Fiber To The Home) technology.

This agreement will also allow Open Fiber to significantly accelerate the construction phases of the network (creation) and activation of the connections (delivery) in the white areas, in line with the objectives of the industrial plan approved last December 3, which reserves areas under concession a significant part of the available resources. More efficiency in the use of infrastructures and the labor factor means not only accelerating the wiring of the country where already foreseen, but also freeing up resources to be allocated to the further development plans envisaged by the PNRR.

“We are very satisfied with the agreement reached which opens a new page of constructive collaboration in the interest of each other and of the country – he comments Mario Rossetti, CEO and General Manager of Open Fiber -. It is, in fact, an agreement made even more significant by the current context characterized by a shortage of manpower and an increase in the prices of raw materials: making investments faster and more efficient is not only rational but also necessary. In particular, the white areas are for us the focal point on which the company’s activity focusesconsidering the significant socio-economic impacts deriving from the reduction of the digital divide in internal areas, through the implementation of the Bul Plan “.

“I am proud of this agreement, which represents another step forward in the execution of our asset enhancement strategy. Thanks to this operation – raise Pietro Labriola, CEO and General Manager of TIM – we create a new source of revenues, generating value for the Group and its shareholders. The agreement also represents one concrete response to the need for connectivity of citizens, businesses and local administrations that until now have not had access to the opportunities and benefits of digital. Finally, this partnership demonstrates how essential it is to have an open and collaborative dialogue with other operators, in a increasingly competitive and strategic market for the country“.

The title Telecom Italia closed the session with a marked increase of 1.50% on previous values.

During the day we witnessed a start strongly supported by the news of the commercial agreement reached by Open Fiber and TIM on the white areas, i.e. those with market failure, seen as the first step towards that hypothesized integration of infrastructures, the so-called Single Network.

Shares of the telephone company opened at € 0.2789 above the highs of the previous session, followed by a weakening that persists in the session.

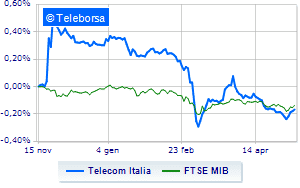

At a comparative level on a weekly basis, the trend of telephone company shows a more marked trend than the trendline of FTSE MIB. This demonstrates the greater propensity to buy by investors towards Telecom with respect to the index.

The medium-term scenario is always negatively connoted, while the short-term structure shows some improvement, due to the stability of the support area identified at 0.2621. The positive short-term movement is indicative of a potential reversal of the bearish trend, with possible attempts to aggression prices towards the important resistance area estimated at 0.2857. The possibility of a continuation of the bullish phase towards 0.3093 is therefore concrete.

The large variance in the prices oftelephone company from the average of the values recorded in the last period, confirmed by the daily volatility which assumes a value equal to 3.103, is symptomatic of an investment characterized by a high risk and therefore designed above all for those who wish to obtain high earnings in the face of the possibility of recording heavy losses. In this context, a very short-term operation is recommended in light above all of the decrease in intraday volumes 76,224,032 compared to the moving average of volumes of the last month set at 104,713,694.