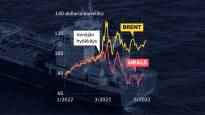

There is a lot of Russian oil, especially in the Mediterranean, but there is still a lively tanker rally in the Baltic Sea. Commodity traders haunted Russian oil for as long as they could.

The EU plans to ban oil imports from Russia – but only at the end of the year. The Commission announced on Wednesday that purchases of fossil fuels from Russia will continue in the coming months.

This works for the benefit of the Kremlin.

The price of oil could rise as companies haul fuel before the embargo begins. This is how the Kremlin war continues to grow.

It is estimated that Russia currently earns just under a billion euros a day from oil and gas sales.

Until the turn of the year, oil brokers can buy Siberian oil as they please – and Vladimir Putin can look for new customers to replace Europeans.

Oil is still flowing in the Baltic Sea

At the beginning of April, the EU banned Russian ships from entering EU ports. However, there is still a lot of Russian oil in both the Mediterranean and the Baltic Sea.

Russian oil has simply shifted to tankers registered elsewhere than in Russia. For example Greek owned (switch to another service) ships carry more than twice as much Russian oil as before the Russian invasion of Ukraine.

Western companies are still buying Russian oil, but its origin and ports of destination are harder to determine. More and more tankers are being loaded in Russia without information on the final destination being found in the waybills. The number of such transports has multiplied since the start of the war, reports Wall Street Journal. (switch to another service)

The Russian oil trade is now run primarily by commodity brokers. According to Reuters (you’re switching to another service) Swiss trading houses have boosted purchases of Russian oil as Western oil companies have begun to drive down their trade.

Even if a Russian tanker does not have access to an EU port, it may not be an obstacle to Russia’s oil trade. A batch of oil may travel from Russia to a European port, where it will be pumped to larger ships, such as those going to Asia.

According to Reuters, one way to obscure the origin of the oil is by mixing. Russian oil is combined with oil drilled elsewhere and is called, for example, a “Latvian” or “Turkmen” mixture.

An import duty could be more effective than a ban

What would be the best way to block the flow of euros and dollars into Putin’s war fund?

Researchers at the incubator Bruegel, which is following the European economy, have calculated that it would be more effective than current plans in preventing it by introducing an import ban more quickly. This would not leave the Kremlin time to acquire new customers to replace the Europeans.

– Fuel prices are interlinked and gas prices may also rise in Europe. This means that Russia’s income could increase in the short term due to the EU import ban, a senior researcher from Bruegel Georg Zachmann stated to Reuters.

Leading researcher at VATT Marita Laukkanen according to which a sudden cut in oil imports could lead to big problems.

– If the oil embargo were to start right from tomorrow, the shock in Europe would be bigger because there is no time left for industry and companies to agree, he says.

The price of oil could also rise sharply when all European demand suddenly falls on the Gulf countries, for example.

However, the long transition period is also problematic.

– The problem, on the other hand, is that there may be foresight. It may well be that Russian oil is being hauled in now, and Russia’s income will only increase in the short term.

Oil embargo raises consumer prices

Households should be prepared for oil prices to remain high in the future. According to Laukkanen, Finns have, on average, good opportunities to adapt, as fuel takes up only a few percent of household disposable income.

– You may be wondering if every car trip is necessary, if you can drive slower or if you can prefer carpooling. Or if you are changing cars, could you choose an energy-efficient alternative, an electric car or a hybrid, Laukkanen from the list.

Chief Analyst at Danske Bank Minna Kuusiston EU countries and their citizens have been surprisingly united in favor of tight sanctions.

Russia’s oil import ban will increase inflationary pressures as rising oil prices also push up other prices. As the rise in consumer prices continues, central bank pressure to raise interest rates will increase. Loan management becomes more expensive.

– Public opposition and criticism of sanctions may increase later if they are seen to lead to strong price increases. In the worst-case scenario, some kind of unrest may also be seen, Kuusisto says.

In the end, a big drop is expected for Russia

Below is a description of oil tanker traffic in the Baltic Sea in recent days. The St. Petersburg route is used for oil, as before.

It is worth noting, of course, that only some of the tankers depicted in the graphics carry Russian oil. According to Customs, for example, oil imported to Finland was replaced by Norwegian North Sea oil as early as March.

Russia has a lot of natural resources and the Kremlin will be able to use the transition periods of sanctions to adjust.

One factor affecting Russia’s oil production is likely to be that the EU is planning a wide range of sanctions. EU tankers should no longer carry Russian oil.

The details of the oil sanctions are yet to be agreed. EU countries resumed talks on an import ban on Sunday as they failed to agree on the details of the boycott for the rest of the week.

The Commission’s proposal is unlikely to succeed as such, as Hungary and Slovakia, for example, are demanding that imports of oil from Russia via pipelines be allowed. They are located inland and have no ports, making it more difficult for them to replace Russian oil.

You can discuss the topic until 11 p.m., Monday night.